Top 30 marketplaces in Germany and Europe

NB: For a better view, some elements of the page are hidden in the mobile view. For a complete view including diagrams, we recommend viewing on a computer or tablet.

Introduction

Retailing via digital interfaces and platforms, whether webshops, marketplaces or apps, has become an integral part of everyday life for most Europeans. The Corona pandemic has once again increased the importance of online retail. According to the Online Monitor of the HDE, the online retail volume in 2021 increased by 13.9 billion euros compared to the previous year to a total turnover of online retail in Germany of 87 billion euros. Online marketplaces recorded by far the greatest growth in retail volume. The marketplace sales of Amazon, eBay, Zalando, etc. grew by 42.4% in 2020 compared to 2019. Their share of German online retail thus rose from 38.0% to 44.0% in just one year. In 2021, the sales of online marketplaces increased by 25.0% compared to 2020 and thus they were able to increase their share of online retail by another two percentage points to 46.0%. It should be noted that the majority of the growth was achieved by the Amazon marketplace in particular, which claimed 34.0% in 2020 and 36.0% in 2021 of the total revenue in German online retail. The remaining marketplaces together can only cover around 10.0% of online retail sales. Together with the revenues generated from its own retail business, Amazon has a total share of 54.0% in German online retail in 2021 (53.0% in 2020).

Online marketplaces or virtual marketplaces describe a virtual location/market space within a higher-level data network within which virtual transactions can be carried out. These transactions are supported by information-oriented value creation activities by the marketplace operator as a third market participant. The marketplace operator fulfills an overview function, coordinates synergies and brings together supply and demand in a qualitative as well as quantitative manner. The services provided by a digital marketplace ranges from demand coverage and supplier management to product development. The individual elements of the marketplace can be of a technical or business nature. Technical elements include search functions and encryption; business elements include catalog and matching systems, auctions, tenders, information exchanges, and financial and logistics services.

Various players are following Amazon’s lead and the appeal of the successful marketplace model. These include: Retailers, trade groups, ad portals, price comparison sites, search engines and social networks. The individual players are driven in part by very diverse motives. Retailers are primarily motivated to maintain their relevance to customers and the associated market share. In contrast to this, search engines and social networks are entering the marketplace business on the basis of the data that can be obtained from the interactions of users on marketplaces.

Among the top 30 marketplaces in Europe considered in this study, around three quarters can be classified as retail companies. The retail companies with digital marketplaces include stationary retailers such as Galeria, Douglas, Fnac, Media Markt and Saturn, but also former mail order companies such as Otto or pure online retailers such as Amazon, home24 or Bol.com.

The strategic consideration of the retail companies is to offer the customer a broader and deeper range of products without having to scale the infrastructure and the merchandise risk in the same way. While the marketplace represents a growth strategy for Amazon and could expand its market share in German online retail from 48 percent in 2019 to 54.0 percent in 2021, for the traditional retail companies it is more a matter of maintaining existing market shares.

Top marketplaces in Europe by type and range of products

Generalist

Specialist

Retailer

Marketplace

Price comparison

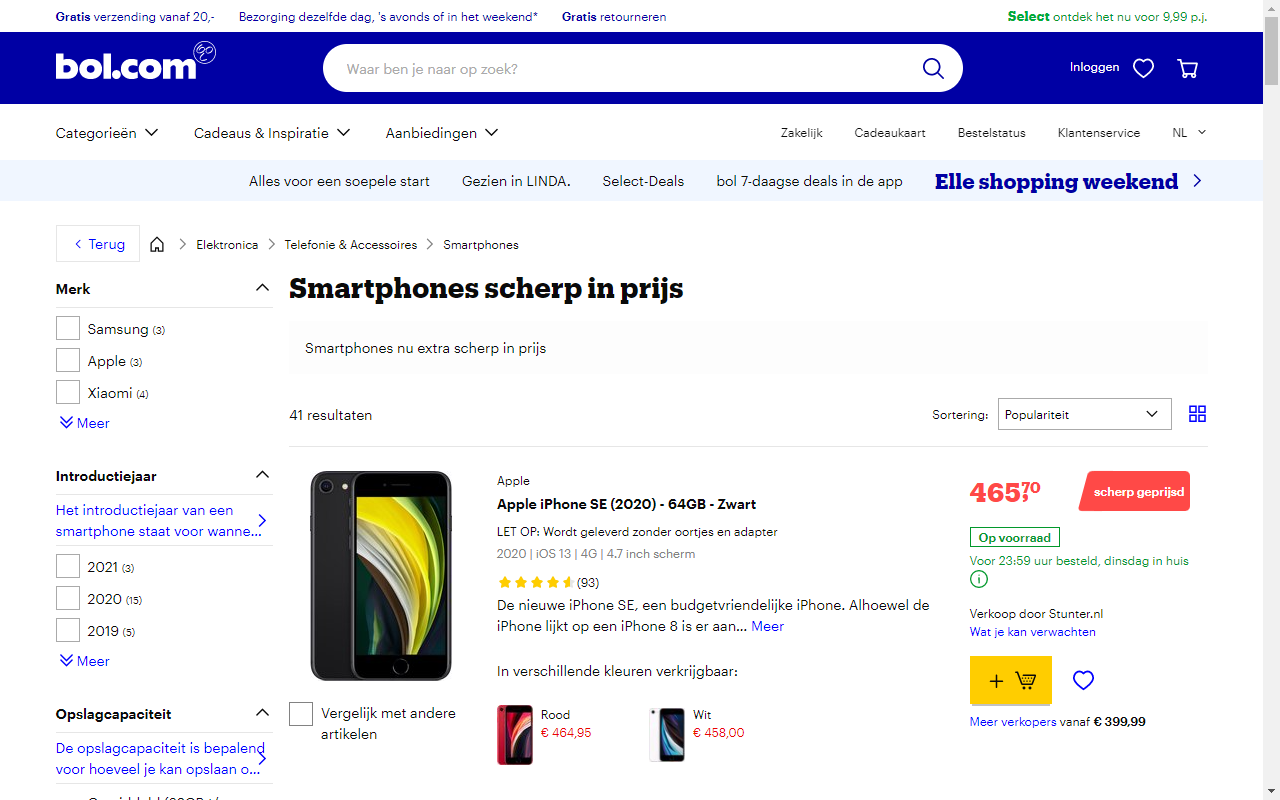

Two thirds of the marketplaces considered here can be considered full-range providers. These include, for example, the online pioneers Amazon and eBay as well as Allegro in Poland and bol.com in the Netherlands. These started out as first movers around 20 years ago and now dominate individual markets.

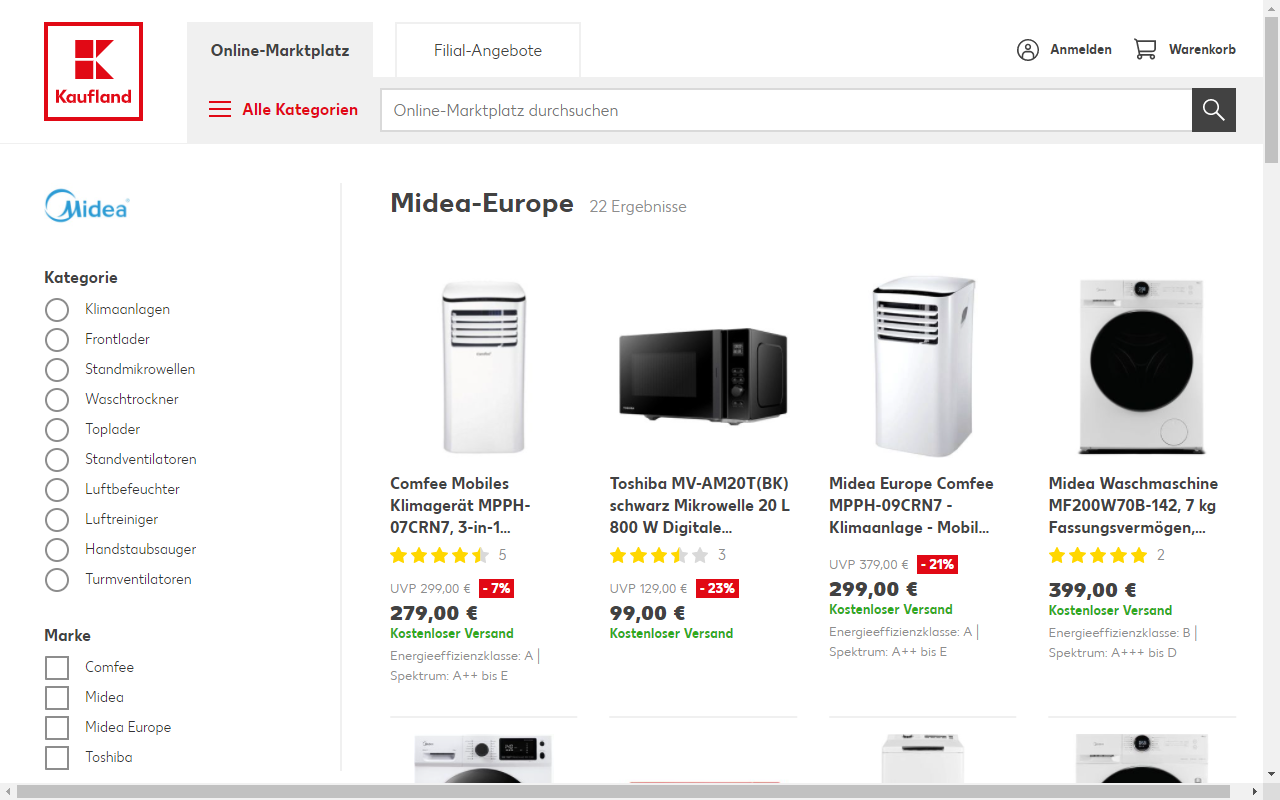

In the last 10 years or so, a number of other players have occupied niches as online pure players in order to better serve customer needs as specialists. For example, Zalando (fashion), Home24 (living) and Manomano (DYI) have seized the opportunity. Established retailers such as Douglas (Beauty) and Media-Saturn (Electronics) are now following suit. Other large retailers such as Otto or kaufland.de (formerly real.de) followed suit a few years ago.

In addition to trading companies, which have now also become marketplace operators, the study also looks at pure marketplaces which, like eBay or Tradera, were founded as such and do not engage in proprietary trading. In addition, the analysis includes two price comparisons, Check24 and Idealo, whose task has already been to supply an interested demand to the offer of as many sellers as possible. Whereas users of the price comparisons were previously directed to the stores, the price comparisons have expanded their range of services and can now also act as a marketplace with an overarching shopping cart for consumers.

Not every player who is currently moving in the direction of the marketplace will be able to hold its own against buyers and/or sellers and achieve the above-mentioned goals. Current developments indicate that competition between platforms will continue to intensify and that great dynamics can be expected on the market. This study presents the 30 most important marketplaces in Germany and Europe and analyzes their positioning in the market along critical factors as well as their advantages for buyers and sellers. Services and concepts along the value chain of the various marketplaces are analyzed.

The analysis of marketplaces can be approached from two predominant perspectives. These result from the two central target groups of marketplaces: Sellers and customers respective buyers. After an introductory comparison of the top 30 marketplaces, these perspectives will be addressed in the following chapters “Analysis along the Buyer Journey” and “Challenges and Opportunities for Sellers”. Finally, an overview of current trends, innovations and other emerging issues related to the most important online marketplaces will be presented.

The top 30 marketplaces in Europe combine 2.1 billion visits per month. With a European population of 750 million, this means that on average each citizen visits one of these marketplaces almost three times a month. This underlines the great importance of the marketplaces. However, the chart below also shows that the distribution of reach even among the top 30 marketplaces is characterized by extreme differences. To illustrate these differences, an analysis of the top 30 marketplaces was conducted based on the key metrics of visitor rate, market share, number of sellers and listings.

Depending on their positioning and reach, marketplaces can be divided into three groups. The international pioneers successfully operate one central and international or several national marketplaces. Amazon and eBay are by far the two largest players on the market. However, Bol.com in the Netherlands, Digitec in Switzerland or Allegro in Poland generate significantly more traffic than Amazon or eBay in their respective countries or markets. Those national champions occupy the top position in their home markets and, possibly following a growth strategy, operate additional, national marketplaces which often still have to establish themselves. It is worth noting that some national champions, despite slightly lower reach, can compete strongly with Amazon and eBay. Examples include CDiscount in France and Otto in Germany. In other countries, Amazon and eBay are hardly active, so that the local champions determine the market. For example, Ozon is by far the only dominant player in Russia, followed by Aliexpress and the fashion marketplace Lamoda. However, it should also be noted that there are also examples of European countries in which no national champion poses a threat to the international pioneers in terms of reach, such as the UK

The last group is made up of the national big players. These are marketplaces with a wide reach and the associated relevance for consumers in the individual countries. Representatives of this third group of marketplaces can be identified in all European countries. Examples of this are Zalando and Douglas in Germany.

Looking at the number of visitors per marketplace per month shown in Figure 1, these groups can be clearly identified.

The international pioneers can claim the excessive share of visitor numbers. However, this is not justified by their business activities in several countries and the resulting cumulative visitor numbers. It can be assumed that the domain “amazon.de”, which is the basis for this study, is predominantly visited by German users or users living in Germany. Possible factors for the nevertheless dominant market shares are the depth and width of the assortment, with at the same time highest price competition. This is initiated because the international leaders usually enable and encourage their affiliated merchants to trade on all national marketplaces. The true dominance of the international pioneers only becomes apparent when the visitor numbers of the individual national outriggers are cumulated. If you add up the visitor numbers of just Germany, Great Britain and Italy, Amazon reaches over one billion views per month.

As already stated, national champions can also compete with and in cases dominate international pioneers. Examples already listed are Otto in Germany and CDiscount in France. However, Amazon in Germany and France each has higher visitor numbers than the two marketplaces on their own. An example of a national champion that beats Amazon is Allegro in Poland with 210 million visitors per month. Amazon, on the other hand, has only 9.2 million visitors in Poland.

The national big players can be regarded as niche marketplaces. They maintain their relevance, such as Douglas, through the depth of their product range. However, these national big players are coming under increasing pressure from growing competition. It can be seen that the national big players in particular have very efficient customer loyalty measures, such as the Douglas Card or Zalando Premium.

Following this introductory overview of the top 30 marketplaces in Germany and Europe on the basis of the most important key figures, the next step is to take the perspective of the customer. The customer forms the demand side and is therefore an essential component of every transaction.

Analysis throughout the Buyer Journey

For marketplace operators, as well as for retailers, an analysis throughout the buyer journey is worthwhile for the evaluation of an online marketplace. Looking at online commerce holistically, only about 4% of website visitors complete a purchase during their first visit to a website. Consumers go through an individual process from their first visit to conversion (purchase), which is defined as the Buyer Journey. The Buyer Journey represents the sequence of steps a customer goes through on their journey from awareness, to being offered a product/service, to making a purchase. Mapping the Buyer’s Journey is a model for mapping all the customer’s interactions with the brand, with the aim of improving these interactions. In doing so, advances in digital advertising and technological innovations allow companies to track their customers’ digital footprints at the most granular level to gain insights into customer behavior.

If this concept is applied to the analysis of the top 30 marketplaces in Germany and Europe, a large number of possible touchpoints can be quickly collected. These can be classified and prioritized in the context of marketplaces by the following fields of action: Merchant and Inventory, Transparency and Trust, Services and Added Value, Payment Processing and Customer Loyalty. In the following, these are stated and explained using the example of the top 30 marketplaces.

It is a prerequisite that consumers and customers assign an individual value to each of these fields and that they thus contribute to a conversion with varying intensity. Marketplaces and their merchants in particular should have a detailed understanding of the preferences of their customers.

Retailer & Inventory

Supply and demand are at the center of customer understanding. In the case of marketplaces, the supply for consumers is formed from the connected merchants and their inventory. This will be examined in the first step of the analysis throughout the buyer journey. An overview of the different retailers and the associated product range structures of the marketplaces will be provided.

Basically, marketplaces can be divided into generalists and specialists. Generalists try to represent all goods available in international trade through the assortment of their merchants. These marketplaces, such as Amazon or eBay, build their relevance on their reach and the depth of the range offered. The aim of the generalists is to become the central point of contact for all consumer demand by offering the widest possible range of products. Amazon, for example, shows that this is possible. The specialists among the marketplaces, on the other hand, strive to become the central point of contact for a specific vertical by offering a particularly deep assortment. Examples of this are, as already mentioned, the online pure players Zalando (fashion), Home24 (living) and Manomano (DIY). In addition, more and more retail brands are complementing their stationary retail with digital marketplaces, e.g. Media-Saturn (electronics) or Douglas (beauty).

While pure marketplaces and generalists tend to offer an open model for commercial traders, more than two thirds of the platforms examined here are closed marketplaces, as they themselves provide an approval procedure for commercial sellers. The reasons for this are, for example, the control of the offer and the service level by the marketplace operator. It is not uncommon for such controls to be carried out under pressure from manufacturers and brands. This can be an advantage for customers, but at the same time high barriers to entry can limit the depth of the product range and competition on marketplaces.

In addition to the positioning of marketplaces in terms of the breadth of their product range and their orientation as generalists or specialists, the breadth of their product range is of particular importance for the competitiveness of marketplaces. With the exception of eBay and Tradera, which also allow end customers to sell on their platforms, all marketplaces only offer commercial sellers the opportunity to sell goods via their marketplaces. Trade-in programs such as Zalando Circle allow end customers to sell used goods, but the resale takes place through Zalando SE. Avoiding C2C business, i.e., sales from end customers to end customers, definitely has advantages for the marketplace, as it avoids legally inconsistent sales contracts or warranty claims for the customer.

Additionally, the restriction to commercial sellers correlates with the claim to offer exclusively new or remanufactured used goods from professionally operating sellers. The market for remanufactured goods in particular has experienced a certain boom in recent years in the context of growing environmental awareness and sustainability trends and has spawned its own marketplaces such as BackMarket or AFound. From a consumer perspective, these offerings are also of great interest, as as-new goods are offered at significantly reduced prices.

Transparancy & Trust

As stated at the beginning of the last chapter, supply and demand play an essential role for marketplaces. One of the most important functions of the marketplace is to bring supply and demand together efficiently. Transparency about the product range and the nature of the products is a determinant of consumer trust in the marketplace and its offerings.

In order to meet this demand in the best possible way, the individual marketplaces structure their product range and product information very differently in some cases, but always with the aim of giving the customer as complete a picture as possible of what is on offer. For retailers, this sometimes leads to very high content requirements that have to be met. In addition to standard product information, good categorization, a functioning search function and other useful filter features are essential for successful matchmaking between customer inquiries and the merchants’ offerings. More than 90 percent of marketplaces also help customers find relevant product ranges by providing individual product recommendations based on their search history and other preference criteria. More advanced platforms also weave historically known customer preferences into their search algorithm and can thus offer an individualized shopping experience.

With regard to price, transparency is less pronounced on marketplaces. Only about one third of all marketplaces offer a full-fledged price comparison between assortments and sellers. Examples of this are Amazon, Idealo or Ozone. It should be taken into account that not every marketplace even allows competition between the sellers of an item or brand.

Alongside transparency, trust between the parties in a marketplace is a key determinant of digital commerce. Ratings of products and sellers or even buyers play an important role here. While the rating of products – by customers or, for example, external test reports – is a standard component not only on marketplaces, the rating of sellers is only possible on about half of all the marketplaces examined here.

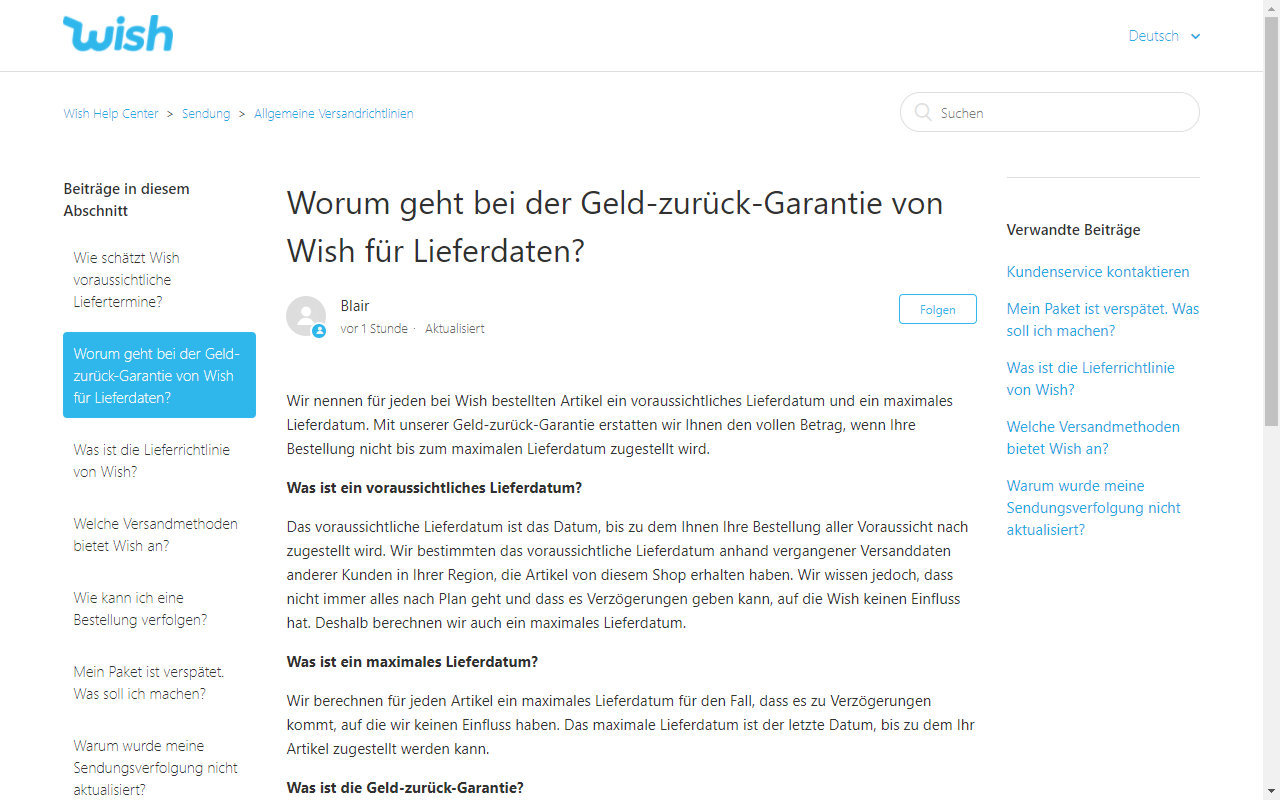

In addition to the trust-building measures mentioned above, some marketplaces offer their customers additional signals of verified quality or a guarantee in case, despite everything, the customer had a bad experience. More than one-fifth of marketplaces offer a guarantee to assure buyers of the promise made about the product or service. These warranties are in addition to the legal warranty provided by the seller or the manufacturer’s warranties, if any. Wish’s money-back guarantee, for example, provides a refund if the product does not arrive on time to the customer. Home24’s Best Price Guarantee promises a full refund if Home24’s price is higher than other sellers. Some marketplaces offer customers product advice via chatbox for interaction before they buy. All these features help customers make decisions and thus lead to an increase in the conversion rate.

Services & added value

Many marketplaces offer buyers additional services and added value around the purchase of goods. More than 4/5 of the marketplaces provide a central customer service to better answer customer inquiries after the purchase and to relieve merchants of this. Thus, offering a customer service is a standard feature of most marketplace operators.

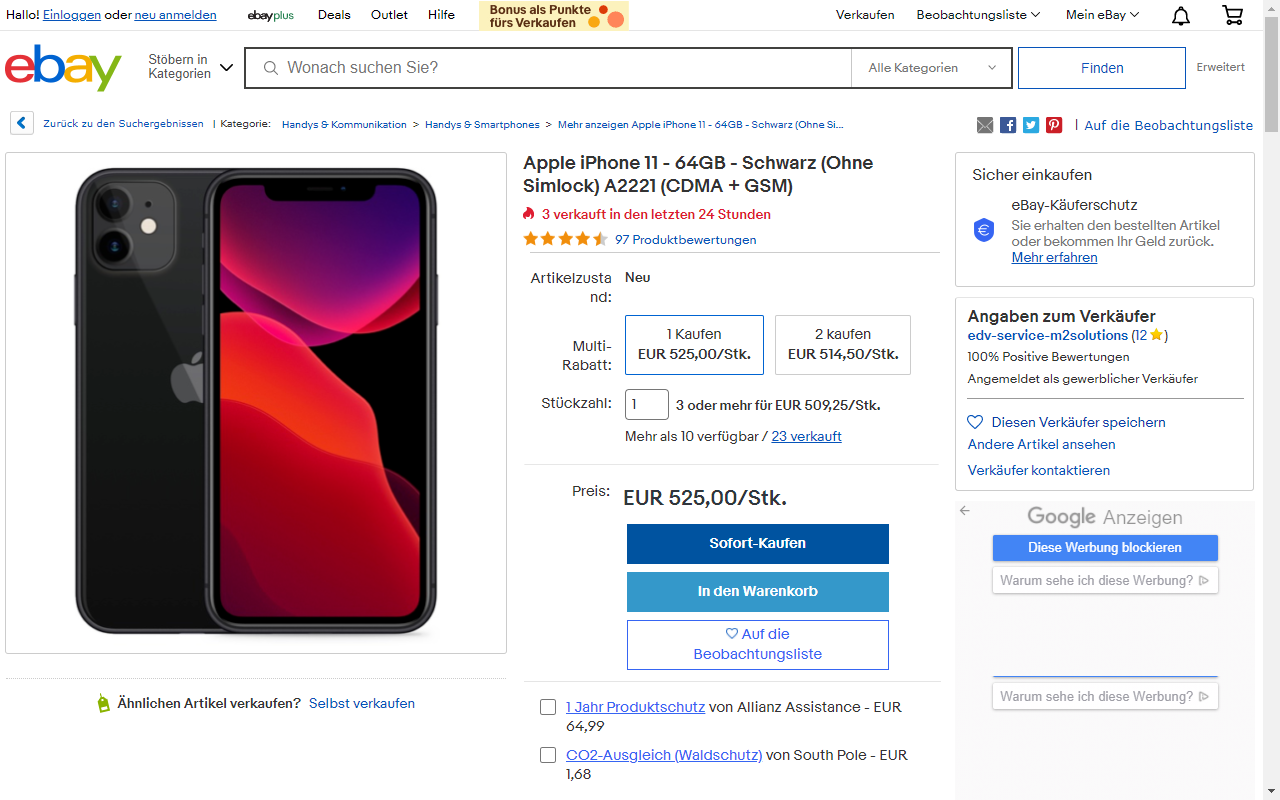

In the “Add to Cart” or “Checkout” step, different add-on services are actively communicated on a group of the marketplaces to serve the additional customer needs. The most common add-on is third-party insurance offers such as Allianz insurance products on eBay, SquareTrade or Amazon or the CDiscount Insurance add-on.

Sustainable, resource-conserving shopping is also increasingly becoming an important decision criterion for online customers. This also includes the question of how the respective CO2 footprint can be reduced when purchasing. The high market share puts marketplaces in a special role of responsibility on these issues. For example, a whole series of marketplaces offer CO2 compensation. The following is an example of eBay’s CO2 compensation.

In the future, customers will tend to expect more of the add-ons mentioned above, and the individual marketplaces will add more innovative features to strengthen their competitive position.

Payment processing

The payment options with a large customer coverage avoid the break in the last step of the purchase process. On average, the top 30 marketplaces in Europe support 7 payment methods. Credit card (93%) and Paypal (80%) are among the most widely used payment methods, followed by bank transfer and installment payment. Some marketplaces even offer their own developed payment methods, e.g. eMag Raiffeisen MasterCard, La Redoute Mastercard, Allegro Pay and Amazon Pay.

In addition, there are different preferences for payment options in the European region, e.g. Ideal in the Netherlands, Bilk in Poland and Klarna in Germany.

Offering different payment options is essential for marketplaces. According to a study by PPRO, 42% of U.S. consumers say they would abandon a purchase if their preferred payment method was not available. Since each customer has their own preferences, marketplaces that offer only one payment method will lose or discourage customer segments whose payment preferences are not covered. Consequently, offering different payment options is an essential competitive advantage. As this study shows, many marketplaces have already ensured that their customers can pay in different ways. Those that do not yet do so will undoubtedly add more payment methods in the future to maintain their market position.

Furthermore, the connection of diverse payment providers reduces the dependency on a single provider. By offering multiple payment options through multiple payment providers, marketplaces can avoid being unable to process sales in the event of a failure or problem with one payment provider. Thus, offering multiple payment options not only adds value for customers, but also provides security for marketplaces.

Customer loyalty

A customer loyalty program is available at 83% of the largest marketplaces. It shows what high relevance long-term customer relationship have. Customer loyalty should contribute to the return of customers and reduce the cost of acquiring new customers. Most customer loyalty measures include benefits on delivery (e.g. free delivery, shorter delivery time) as well as access to exclusive deals and services, e.g. Amazon Prime, eBay Plus, Ozon Premium, Saturn Card, Allegro Smart and lamoda club. Some loyalty programs also offer financial benefits such as CashBack and Pay in Installment, e.g. Douglas Beauty Card, Payback at Rewe, La Redoute & MOI. In addition, longer return period, access to cultural offers such as music and movie are also included in the loyalty program at some marketplaces.

Challenges & Opportunities for Sellers

Marketplaces offer great opportunities for sellers – be they manufacturers or brands, brick-and-mortar or online retailers, refurbishers, fulfillment service providers or other players. Marketplaces usually offer a large reach and the possibility to present the offer of the dealers to them. For sellers, among other factors, the question is whether the revenue to be generated on the marketplace can compensate for the costs of setup and operation.

While the operating costs are defined, among other things, by the fee model of the marketplace and by the operating costs, the setup costs include, among other things, the technical integration, any necessary expenses for content and listing of the assortments, and the provision or scaling of the operating capacities, e.g., for channel marketing or warehousing and logistics. In the case of sales in other European countries, there may be additional challenges based on language or legal differences, for example. How the European marketplaces help German sellers to solve these challenges will be examined in a separate deep dive.

Setup, Integration & Listing

As already stated at the beginning of the chapter, it is important for merchants to check whether the potential of the marketplace allows the investment in setup, integration and listing of products. The entry hurdles on most marketplaces are rather low. However, the requirements for the merchant, e.g. in terms of shipping or item content, can differ significantly between the various marketplaces. As part of the account creation process, most marketplaces usually require commercial sellers to have a company registered in the respective country. This is not a challenge for German sellers on a German online marketplace, but it can quickly become a hurdle for sales via European marketplaces abroad. For merchants who do not want to set up a foreign company directly, Amazon or eBay, for example, offer the option of cross-border trading via a national account.

All marketplaces offer or require integration of the processes between seller and platform. This starts with the setting of the assortments, continues with the order and payment processing as well as the shipping and tracking process and ends with customer communication and after-sales issues. Omnichannel and middleware providers help sellers to operate the interfaces of the marketplaces and support the processes of the retailers. The first step is to analyze which of the top 30 marketplaces are addressed by which of the providers.

Product information is a major challenge for retailers, especially smaller retailers. High-quality product information is also the basis for high product visibility. Currently, about a quarter of the marketplaces provide a central catalog and thus take over this task for online retailers. However, this requirement still exists for a large group of the top marketplaces, let alone the small ones.

Onsite-Marketing & actions

In the top 30 marketplaces, there is a strong battle for product visibility and ultimately customer attention. In addition to organic discoverability, 93% of the top marketplaces offer sellers onsite marketing options. Most marketplaces offer a range of different onsite marketing campaigns. The most common of these are coupons, promoted listings, and marketplace-wide campaign packages.

The coupon option is the most common. To be able to participate in a coupon, the popularity of the products, the discount offered, the available inventory and the relationship with the account manager at the marketplace operator usually play an important role. Merchants thus have the opportunity to increase their conversion rate. Coupons are usually offered for certain products or above a certain purchase value in order to increase the value of the shopping cart. Coupons are often already displayed in the product search. In the further funnel, coupons can be displayed on the product page and in the checkout process.

Promoted Listings are an onsite marketing offer that almost all marketplaces offer their merchants. Here, the merchant can acquire the first ad in the product search. These placements are mapped on the individual marketplaces by processes and mechanisms, some of which are fundamentally different. These can be cost-per-click or cost-per-order models. In addition, the marketplaces differ in the level of consideration of the quality factor of the merchant’s offer. Relevant factors for the quality factor include the quality of the content, the number of sales, and product and merchant ratings.

Marketplace-wide campaigns can have quite different complexity and reach in the marketplace. Most marketplaces offer their customers a selection of products in connection with an exclusive price advantage. For this, merchants can advertise their products and must provide a certain inventory in conjunction with an agreed price. Other marketplace-wide campaigns can include banner ads and special placements on the marketplace website. Merchants are primarily motivated by the reach of the individual options and want to increase their awareness as well as the number of sales.

Fulfillment Services

Fulfillment is now one of the most important services offered by marketplace operators. Marketplaces can leverage their economies of scale to reduce storage, packaging, delivery and returns costs, especially for smaller sellers, and shorten delivery times. Currently, fulfillment is available at 13 of the top 30 marketplaces and the trend continues to point in that direction. This service can be set up either internally, e.g. Fulfillment by Amazon, or through a partnership with a logistics partner, e.g. Fulfillment by eBay in a joint venture with Orange Connex.

This fulfillment offering opens up the marketplace business to a previously unreached group of merchants. Small merchants in particular often do not have the necessary resources to efficiently handle logistics internally. The marketplace thus covers the global supply chain and delivery for e-commerce merchants of all sizes. Merchants store their goods with the marketplace, which takes care of picking, shipping and returns management. Most marketplaces have various local warehouses to guarantee the fastest possible delivery times.

Charging model

The charging model determines the revenue sources of the marketplace operator towards the sellers. Apart from that, the fee model is also an important means to influence the behavior of the merchant. For example, it is common to penalize sellers with persistently poor customer service by charging higher fees to guarantee a change in behavior or to exclude the merchant because its margin no longer covers the increased sales fees.

Most online marketplaces are oriented towards one or even a combination of the following three strategies: commission, subscription and listing fees. In fact, however, there are many more revenue models on the market. Each of them has its own advantages and disadvantages for merchants, as well as difficulties in implementation by the marketplace operator.

The common types of fees charged are monthly subscription fee and percentage commission, which are based on the transaction volume and are only settled upon sale. The monthly fee is usually 20-50€ and is intended as an incentive to actively sell. eBay and Allegro also offer different packages with different features and associated monthly costs. The more expensive packages often include benefits such as discount for commission or support from an account manager of the marketplace operator.

The commission at the conclusion of the sale allows minimal risks for the traders, since only after sales are achieved, costs are incurred for the sale through one of the marketplaces. The top 30 marketplaces have different ranges of commissions, which are considered the main source of revenue. The emerging marketplaces such as Galeria (3-10%) and Check24 in (5-10%) DE charge comparatively much lower commission than the established and much larger marketplaces Amazon (7%-20%) and CDiscount (5%-20%).

Commission on the top 30 marketplaces varies by category and reflects the margin structures of the individual segments. Commission for the Fashion and Health & Beauty categories is typically higher than the Electronics and Home & Garden categories. Less frequently seen are fixed fees per item sold (at eBay, bol.com), payment fees (at eBay) or one-time entry fees (at Wish).

New potential for marketplaces

The above chapters have shown how marketplaces can differentiate themselves from buyers and sellers throughout different themes. However, the most important task of a marketplace continues to be the provision of the broadest possible assortment – if necessary within a specific vertical or a specific orientation. The trend towards more and more marketplaces aggregating the usual market assortments inevitably leads to marketplaces having to differentiate themselves from one another. A demarcation, which must take place primarily over the offer. It is therefore worth taking another look at special developments and trends for product ranges. Four approaches that have become visible across the landscape of marketplaces will be presented as examples:

The above chapters have shown how marketplaces can differentiate themselves from buyers and sellers throughout different themes. However, the most important task of a marketplace continues to be the provision of the broadest possible assortment – if necessary within a specific vertical or a specific orientation. The trend towards more and more marketplaces aggregating the usual market assortments inevitably leads to marketplaces having to differentiate themselves from one another. A demarcation, which must take place primarily over the offer. It is therefore worth taking another look at special developments and trends for product ranges. Four approaches that have become visible across the landscape of marketplaces will be presented as examples:

Exclusive brands (“Creator Economy”)

As part of the so-called creator economy, many marketplaces cooperate with influencers, who on the one hand bring their own reach and target groups. The goal of the marketplaces is to cooperate as exclusively as possible with influencers, to develop products or brands and to sell them via their own marketplaces in order to reach the relevant target groups and to distinguish themselves from other marketplaces. This strategy applies to both retail companies and marketplaces. However, influencers do not always have to be in the foreground, as the marketplace Etsy, which was not considered in our study, proves, where thousands of small and private “creators” successfully sell their assortments. Aboutyou is actively involved in the “Creator Economy” and is building new brands together with influencers with a wide reach, which are sold exclusively on Aboutyou.

Second-Hand (“Circular Economy”)

Resales: The circular economy is fundamentally about sustainability through the reuse of things and the promotion of sustainability. While eBay, for example, was once created as a platform for resale by private and commercial sellers, other marketplaces have only taken up the topic in recent years. According to our analysis, 12 of the marketplaces studied currently offer opportunities for reselling assortments, mostly as part of “refurbished” programs and more or less transparent quality control.

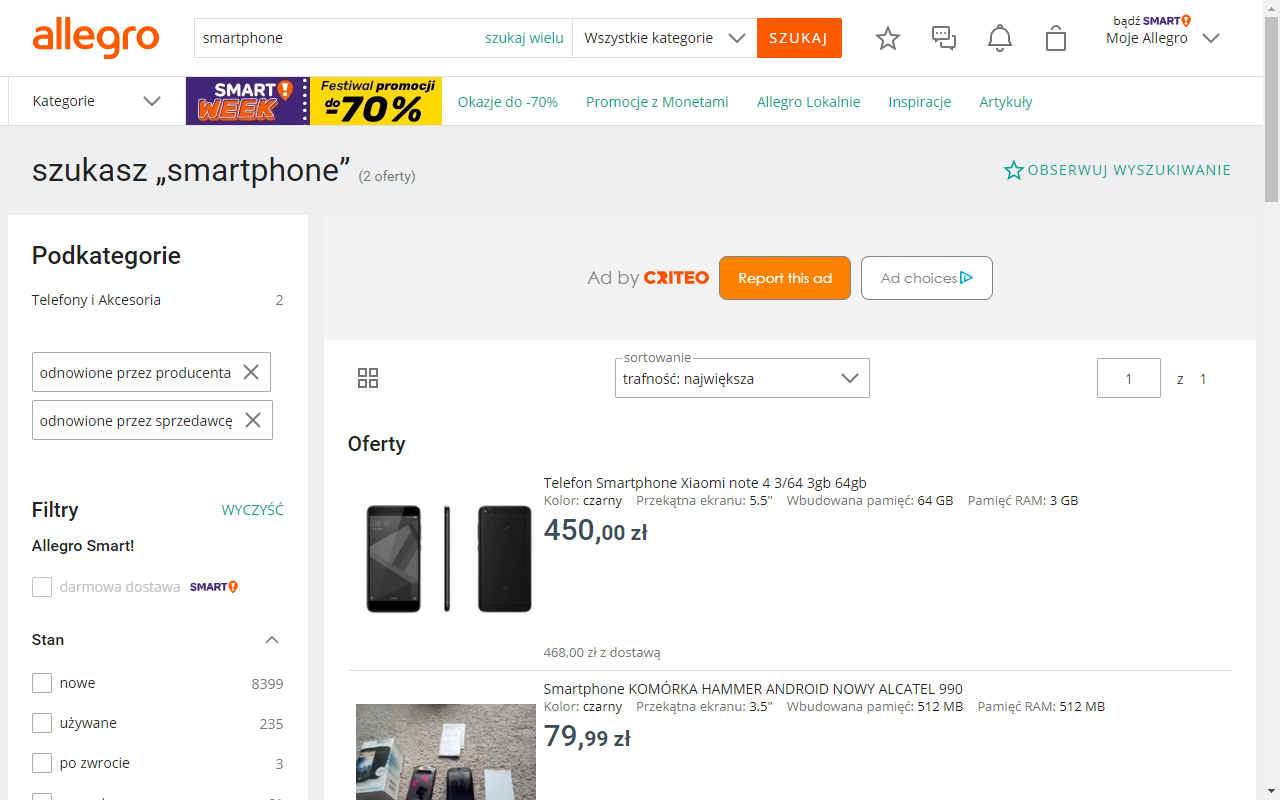

On allegro.pl several filters for refurbished products are integrated on the homepage, Refurbished by Manufacturer and by Reseller. This indicates the careful differentiation of these products to significantly help customers sort and search. In addition, the customer will find a detailed description of the product’s condition on the product page. Often, the customer can still get a month-long warranty from the dealer. This shows that ensuring product quality and warranty are the main issues that the marketplace operator should address.

International sales (“Cross Border Trade”)

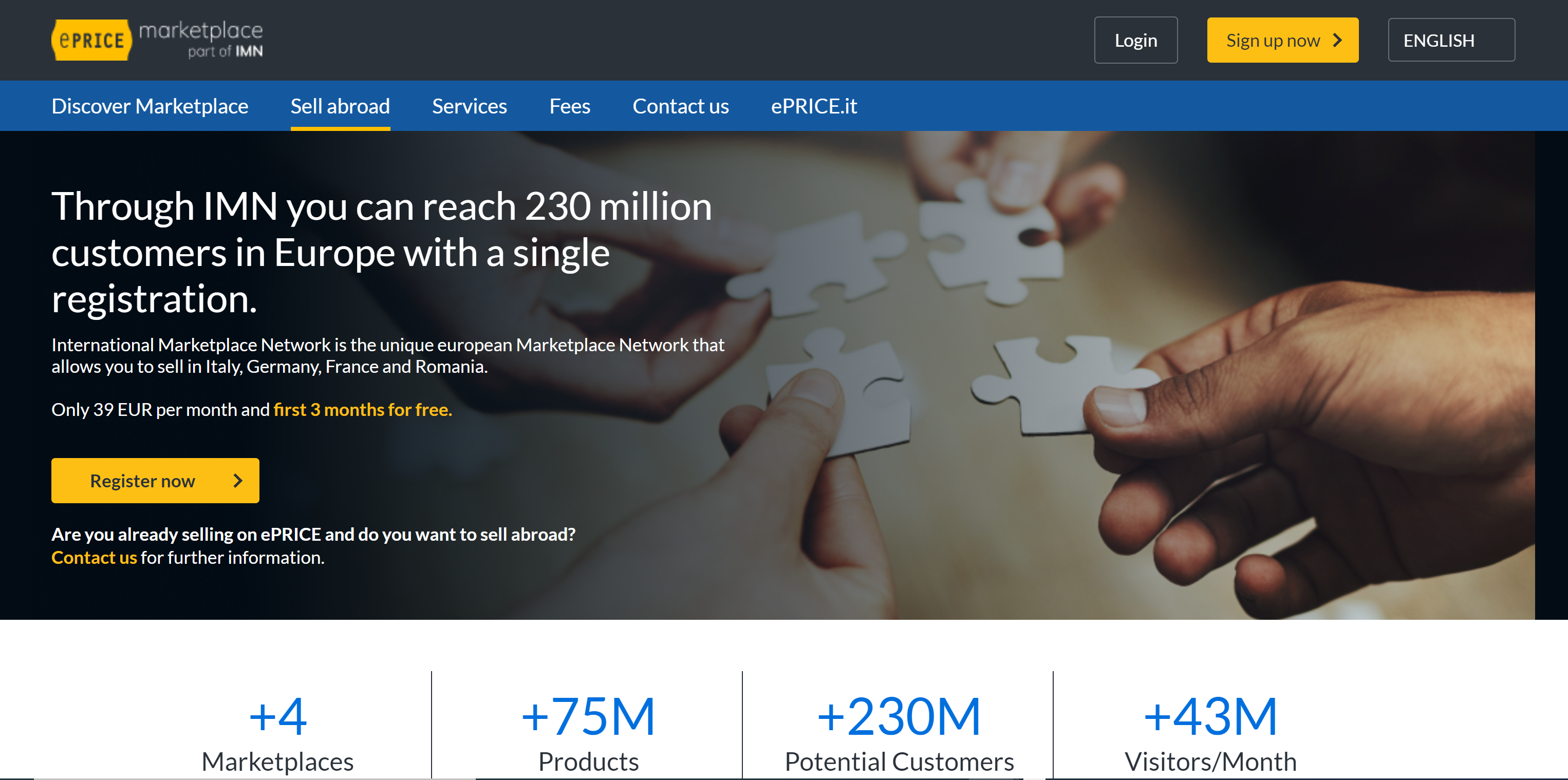

For the internationally active marketplaces, it is advantageous to show the range of their merchants on as many country platforms as possible and thus compensate for any gaps in the product range in smaller countries or offer customers attractive prices in countries with less competition. At the same time, sellers can tap into new markets without having to set up a complete infrastructure for each country. While these advantages could be realized on the one hand by internationally active marketplaces, e.g. Amazon or eBay, some national marketplaces try to achieve these effects through cooperation, e.g. International Marketplace Network. For marketplaces such as Alibaba or Wish, cross-border trade is even the basis of the business model.

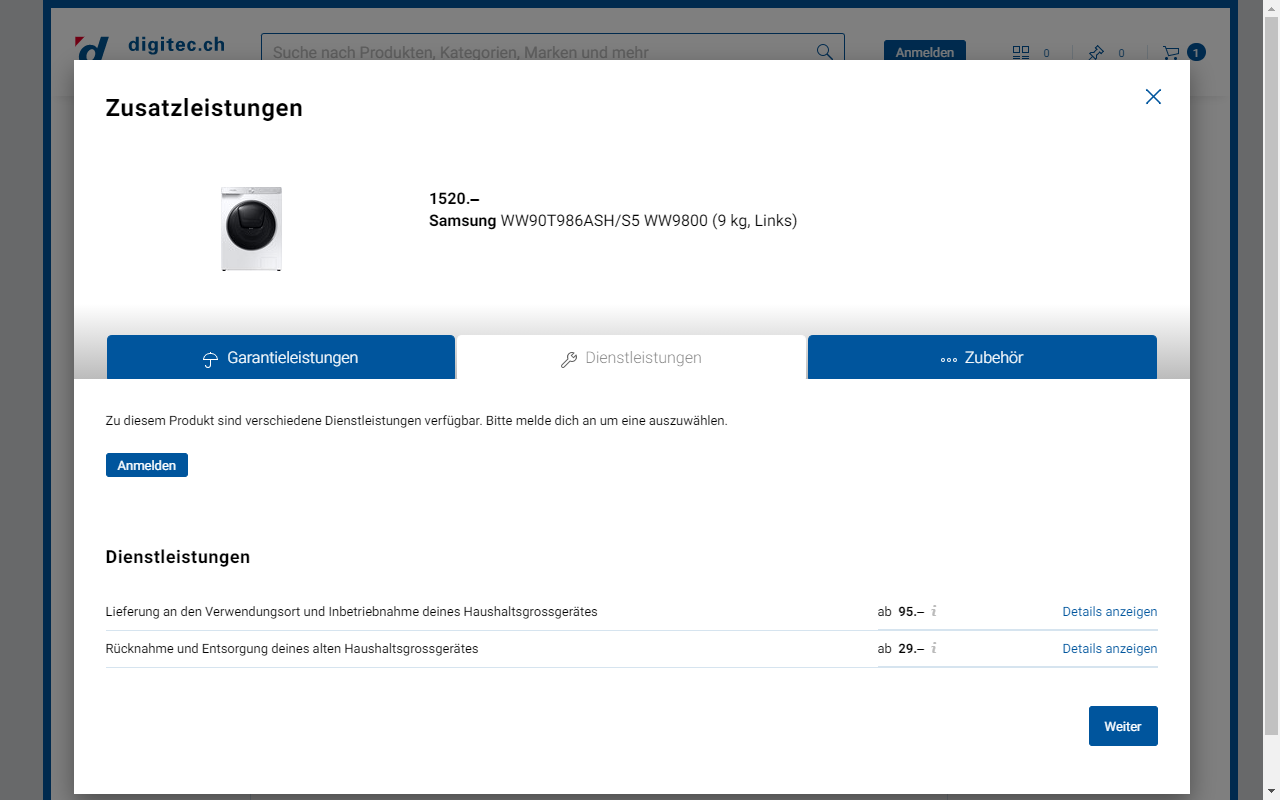

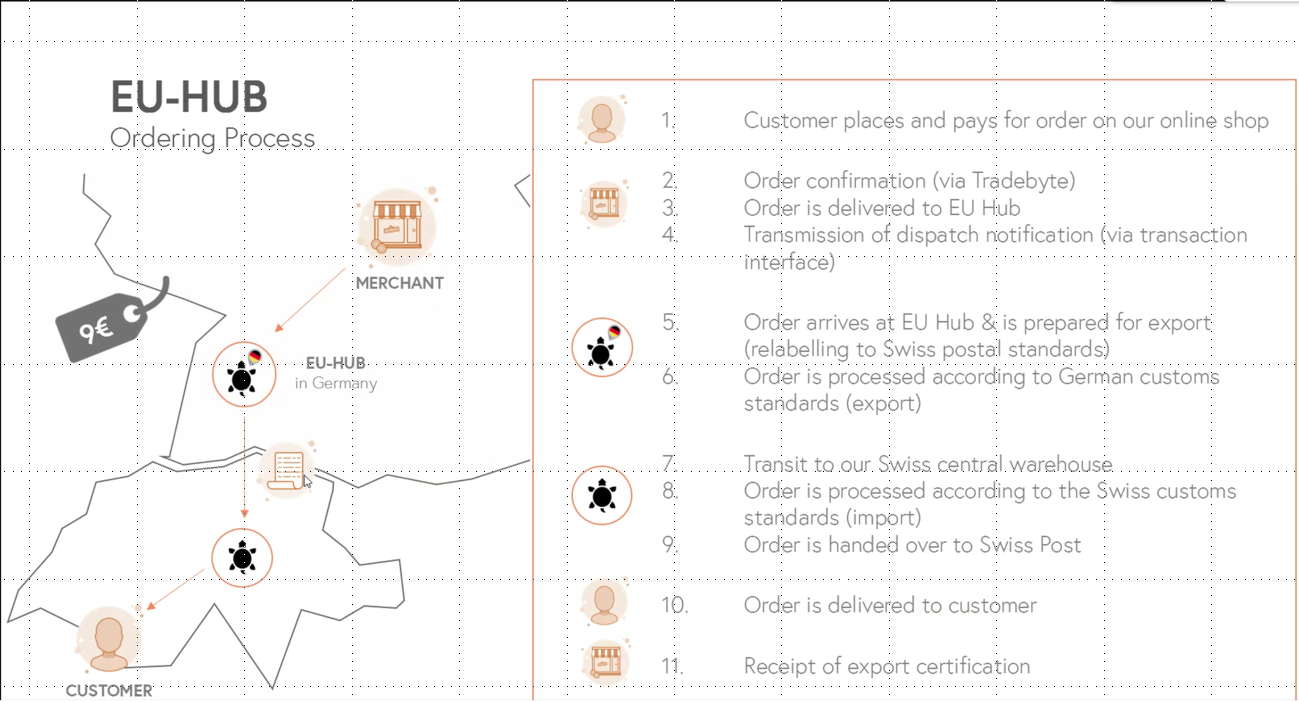

With Amazon, merchants have the ability to display their products on all European platforms with one account. The central catalog facilitates the setting of listings. In addition, the Amazon Fulfillment Network takes care of storage, delivery and returns in the target market. Similarly, the Swiss market operator offers German retailers logistics services geared to international trade, which meet legal and tax requirements. In the logistics solution, an EU HUB warehouse in Germany is offered by Digitec and Digitec’s central warehouse in Switzerland is provided.

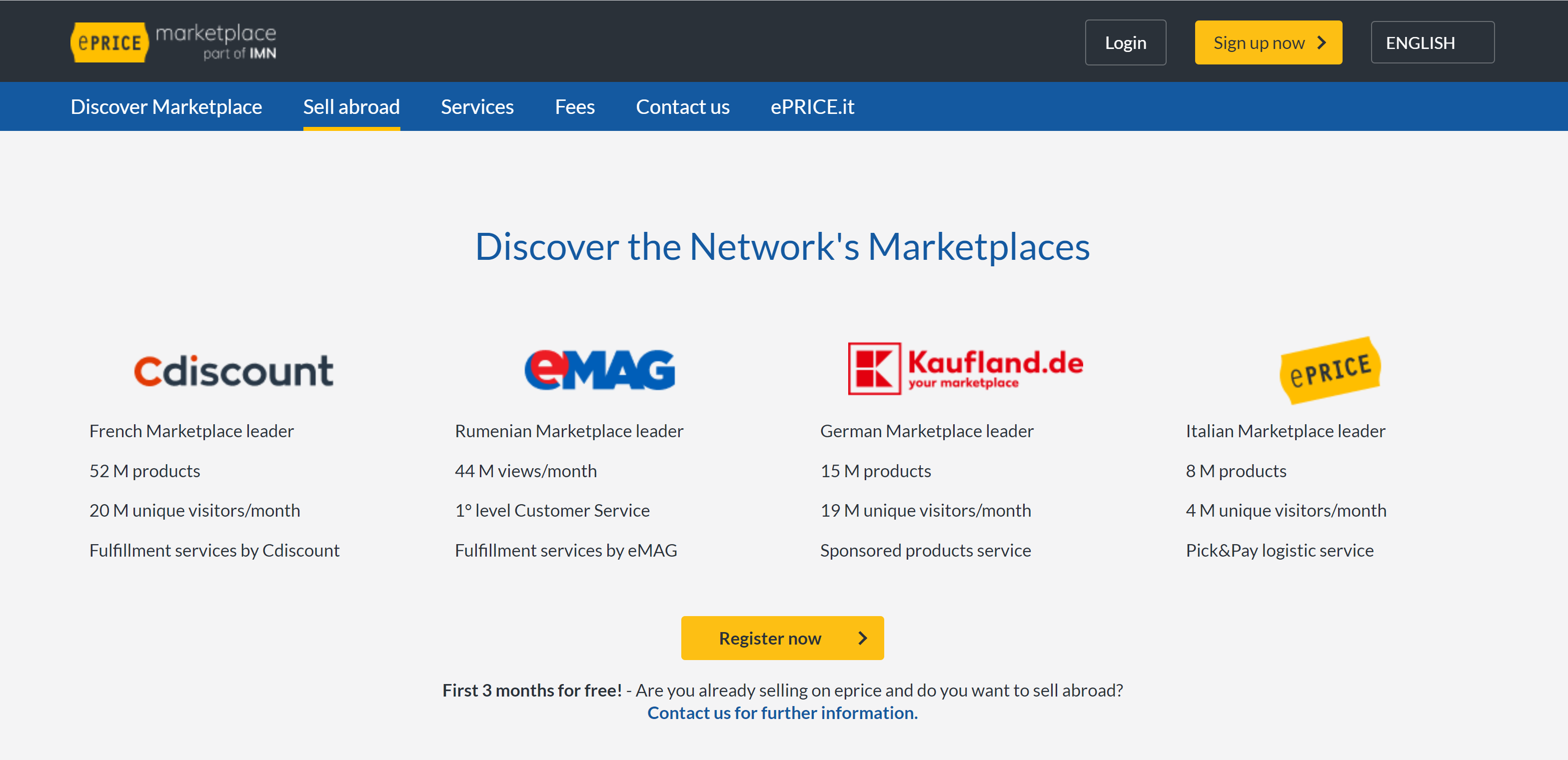

In addition to the concept approaches to facilitate selling on their own marketplace in other markets, some major players in different European regions are joining forces to form an alliance. The International Marketplace Network (IMN) currently consists of ePrice in Italy, CDiscount in France, Kaufland.de in Germany and eMag in Romania. After activating an IMN account, any merchant from one of the marketplaces can display their offers on the partner marketplaces. No new technical connection is required and listings are automatically translated in the backend. With this approach, it remains to be seen whether corresponding logistics services will be offered and how many more partners the network can connect.

Stationary inventory (“Connected Commerce”)

Despite a growing share of online retail in total sales, brick-and-mortar retail is still significantly larger and thus also represents the greatest potential for scaling. While many of the large retail organizations are already active online, many of the small owner-operated retailers are still shying away from taking the step in this direction. So this is also an opportunity for marketplaces – whether as an inventory reserve for vertical marketplaces (and sellers) like Zalando, or to ensure a certain diversity of supply for platforms like eBay. The Corona crisis has also led to a new awareness of brick-and-mortar retail among customers, who are certainly embracing some of the following initiatives.

eBay Deine Stadt (eBay Your City) is an initiative by eBay Germany and the German Retail Association to strengthen stationary retail. eBay offers cities and regions the opportunity to implement a low-cost and sustainable local online marketplace and thus provide local customers with the most comprehensive overview possible of local retail assortments. For merchants, there is the opportunity to be visible on both the eBay marketplace and a local online marketplace at the same time. In addition, eBay is committed to helping merchants get off to a successful start with a comprehensive program. After only one year of operation, 30 cities and regions are already participating.

On the Otto.de marketplace, local availabilities are displayed for some retailers. The data originates from the “Digital Mall” project of sister company ECE, which now records the inventory of over 100 retail partners and displays it online for more than 65 malls. This information is also displayed on Otto.de and offers customers the opportunity to try on and purchase the goods they are looking for in the stores of the participating partners. Transactional embedding is not yet apparent, but is certainly conceivable in a next step.

The Zalando Connected Retail initiative enables local fashion and shoe retailers to connect the inventories in their brick-and-mortar stores to the Zalando platform via software. In doing so, Zalando secures an extensive virtual inventory, which leads to higher availability for seasonal items without Zalando having to take a higher risk with regard to its own inventory. This can still be to the advantage of brick-and-mortar retailers and an opportunity for additional sales. Ultimately, however, this approach is not a true marketplace model.

Short profile & Contact – eStrategy Consulting

eStrategy Consulting helps clients to use digital innovations to further develop existing business models and to create new business opportunities. We support the retail industry in its further development towards omnichannel and connected commerce and count manufacturers, classic big box retailers, the retail real estate industry or digital marketplaces and platforms among our clients.

eStrategy Consulting covers the entire lifecycle of digital innovation, from analysis to ideation, solution development and market launch. We work as strategy and concept developers as well as seamlessly integrated and pragmatic implementation managers. To do this, we rely on a mix of methods from the world of digital business and classic management consulting. The focus is both on our client’s applying customers as well as his organization and skills necessary to operate.