Direct-to-consumer: Three key questions that determine the success of manufacturer webshops of top brands

The development and scaling of an own e-commerce business – i.e. an own web store – is currently one of the dominant topics in the marketing and sales departments of manufacturers in all sectors, such as consumer electronics, home & garden or sport and wellness. The same applies to B2B manufacturers, who are increasingly developing and implementing strategies for direct online purchasing.

The motivations for this are clear and are generally made up of individual combinations of the following potentials:

- Direct monetization of your own online reach: For high-interest products in particular, visiting the manufacturer’s website is already a standard part of the customer journey. After all, no one should be able to provide as good and comprehensive information about their products as the manufacturer itself. So why not monetize this reach directly?

- Building long-term, valuable and customizable customer relationships: Omnichannel marketing by manufacturers has always aimed to build direct relationships with as many customers as possible via their own digital channels. In-house e-commerce now makes it possible to learn even more about the customer, to develop relationships in an even stronger and more individualized way and to actively develop the customer lifetime value of each customer.

- Strengthen loyalty and prevent churn: The stronger relationships that can be built with customers through e-commerce enable manufacturers to shape and develop customer loyalty themselves, independently of retailers, who may be inclined to recommend other manufacturers more at any time.

- Reducing relative marketing costs, i.e. the share of marketing in sales: No marketing is as cost-efficient as the digital, data-driven and personalized reactivation of existing customers via your own channels (website, app, newsletter, …), because customer relevance is high and no budgets are required for media or performance marketing.

- Create sales channels for innovative product ranges that retailers cannot sell or can only sell to a limited extent: This can include, for example, circular economy strategies with certified refurbished old appliances. And, of course, this also involves digital services from manufacturers, which are often offered as subscription-based business models that cannot be sold via retailers’ checkout processes.

Launching your own e-commerce business requires the development of extensive operational and technical skills: Online marketing must be intensified. E-commerce and order management systems are required for the web store, which must be adequately connected to the ERP and CRM systems – which often need to be expanded for this purpose. Logistics, returns and customer care processes need to be set up. New capabilities such as price management need to be developed. The investment framework required for e-commerce quickly becomes a multiple of the budgets previously used for online marketing.

However, it is not only the establishment of a professional infrastructure that is crucial to the success of expanding your own omnichannel marketing activities to include e-commerce. It is also crucial to give your customers a reason to buy from your own online store and thereby generate sales in the first place: Why is your own web store better than the existing competition? What more attractive added value can be offered to the customer that retailers, for example, cannot offer? To do this, manufacturers must realize that a given attractive value proposition for their own products in no way guarantees that the value proposition of their own sales channels is also attractive.

At the same time, this question poses a major risk for the consequences of setting up an attractive webshop: What happens to existing relationships with retail partners if your own web store becomes more attractive than the retailers’ sales channels?

In this study, we therefore want to look at three key questions that are essential for the success of omnichannel marketing expanded to include e-commerce:

To this end, we analyzed how top manufacturer brands from various sectors such as consumer electronics and home appliances answer these questions on their online channels and web stores. Our analysis is based on an outside-in approach and only on findings that are visible from the outside. We looked at established German and international manufacturers, but also at relatively young brands that have been developed in the last 10 to 20 years, i.e. brands with a strong digital DNA – quasi digital natives of the brand world.

1. Value proposition for the purchase in the manufacturer’s webshop

In the omnichannel customer journey, every competitor is just a click away for the consumer. As a result, only the best offers prevail and customer loyalty declines. Of course, this not only applies to the competitiveness of products, but also to the competitiveness of sales channels. Only if a manufacturer’s online store offers a better overall customer experience than other online sales channels – especially those of established retailers – will it establish itself in the market.

Many manufacturers try to rely on the fact that the appeal of the brand is sufficient to immediately transfer product appeal to the appeal of their own web store. But why should this be the case? If another webshop offers a better price, better service or other benefits, the customer can still buy the same branded product, but under better conditions. At the same time, manufacturers will, for understandable reasons, strive to achieve price attractiveness not simply by radically reducing prices and thereby entering into a price war with their own retailers.

We will take a closer look at the following approaches to good value propositions below:

1.1 Price attractiveness

When a customer has completed the product selection process and is only concerned with answering the question of where and via which channel a product is purchased, the price plays a decisive role in the purchase. This reality is an important fact that manufacturers must not ignore when determining the value proposition of their own online store. In addition, the manufacturer faces two challenges, which is why price attractiveness is the most disruptive value proposition of the online store. On the one hand, an attractively priced manufacturer’s own webshop harbors the greatest potential for conflict with retailers. On the other hand, a permanent undercutting of the RRP by the manufacturer is not even possible from a legal point of view, at least not via strike prices. However, indirect price advantages and campaigns are permissible. We present some possibilities below.

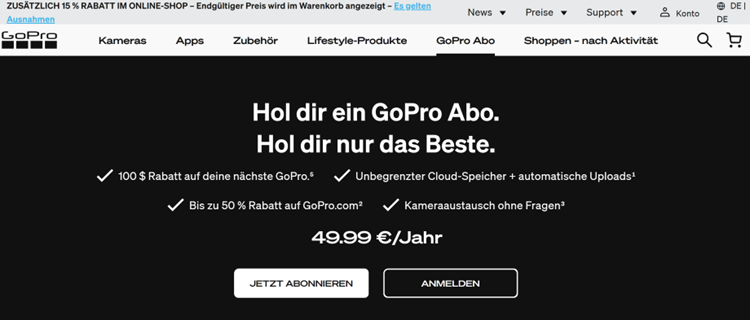

GoPro: Kamera- and App-Packages with Discounts and Vouchers

GoPro is an example of a very consistent pricing strategy geared towards added value for the customer. The most important cornerstones:

- GoPro cameras are offered on the GoPro website at an RRP of around EUR 500 to 600. GoPro grants a discount of EUR 150 to 200 on this price, depending on the camera, if the customer takes out a GoPro subscription of EUR 49.99 per year at the time of purchase. The overall discount, taking into account the subscription, is therefore 20 – 25% of the RRP.

- The GoPro subscription offers the customer an unlimited cloud service for storing recordings, creating videos and distributing them to the smartphone. In addition, premium tools for image editing can be used free of charge.

- By purchasing a camera in combination with the subscription, discounts are also offered for the purchase of up to three additional cameras, ranging from EUR 100 to EUR 120 per camera.

- Furthermore, up to 50% discount is granted on accessories and lifestyle products, i.e. on a normally very high-margin range.

Subscription model from GoPro (gopro.com)

Customer perspective: When purchasing a camera in combination with the GoPro subscription, as a customer I can already benefit from price reductions for other GoPro products in the first year, which can total up to around EUR 500 (the exact value depends on the product – this amount is already roughly equivalent to the price of the entire camera purchased). Buying directly from GoPro therefore offers me attractive prices that are at least competitive with the best prices from dealers and also offers a significantly better brand experience than buying from a dealer.

Assessment from the manufacturer’s perspective: The high price discounts sound surprisingly high at first. Nevertheless, it can be assumed that the pricing strategy implemented on the company’s own webshop makes sense from both the top line and the bottom line perspective: the price attractiveness of the company’s own webshop creates the basis for a high number of customers and a very high turnover (top line) per customer, a high customer lifetime value.

The model is also likely to work well from a margin perspective, as GoPro deducts the discounts from the USP, whereas the best prices in retail are already 20% to 25% below the USP (sample). The GoPro margin is also favored by the elimination of the retailer margin. The elimination of additional costs to support trade marketing and for dealer training will presumably be replaced by slightly higher setup and operating costs for the company’s own web store.

Overall, the margin across all discounted cameras (initially purchased camera and three additional cameras) is likely to be even better than when sold via retailers.

And: the apps offer GoPro direct access to customers and very specific knowledge about the customer-specific use of the products, refinanced via a new revenue opportunity.

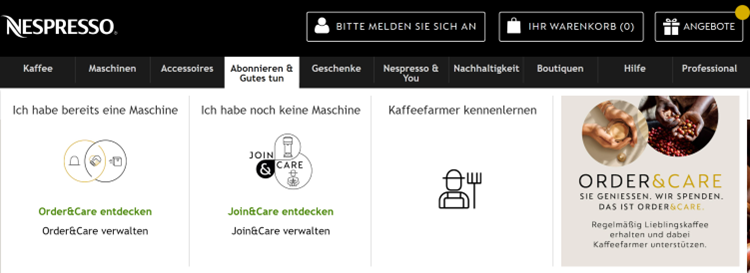

Nespresso: Subscription models

Nespresso is probably still the strongest brand in the coffee capsule business, perhaps even the category-defining brand (similar to Tempo for handkerchiefs). Nevertheless, Nespresso needs to consider how to differentiate not only its own products (machines and capsules) but also its own distribution channel. Two initiatives are particularly worth mentioning:

- Order & Care is an order subscription where customers decide in advance to have a pre-defined number of coffee pods (10 capsules each) delivered at certain intervals. For every 10 bars ordered, they receive one bar of capsules free of charge. For every 10 pods, Nespresso donates an additional EUR 1 to the Nespresso coffee farmers’ pension fund (at around EUR 5 per pod, this corresponds to approximately 2.5% of sales). The subscription can be canceled at any time.

- Join & Care is an order subscription that can only be canceled after 12 months at the earliest and includes a fixed monthly consumption credit of EUR 20 to EUR 130, i.e. EUR 240 to EUR 1,560 for 12 months. The subscription includes the purchase of a Nespresso coffee machine worth (RRP) between EUR 109 (ESSENZA MINI, at EUR 20 per month) and EUR 749 (CREATISTA PLUS, at EUR 130 per month). The total price advantage for the customer for the machine and coffee is therefore 45 – 48%.

Abo-Modelle von Nespresso (nespresso.de)

Assessment from the customer’s perspective: The price discounts of 45 – 48% offered as part of the subscriptions initially sound impressive. However, this is put into perspective when looking at the best prices offered by retailers on the Internet. The ESSENZA MINI, priced at EUR 109 by Nespresso, is available for a best price of around EUR 75, the CREATISTA PRO for EUR 597). Nevertheless, the bottom line is a discount of 31 – 38% on the machine and capsules in the first year.

Assessment from the manufacturer’s perspective: The high delta between RRP and Internet best prices suggests the high margins Nespresso has when selling Nespresso original machines and how unlikely it is that customers will buy the machines directly from Nespresso at the RRP. This relativizes the initial costs for Nespresso that arise from selling the machine at a price of EUR 1. The ROI will be generated by the targeted high customer lifetime value, either directly through the subscription or through the capsules that continue to be purchased from Nespresso after the subscription expires.

At the same time, this approach enables Nespresso to offer the customer an attractive price and still allow the retailer to remain the price leader.

Leica: Cross-Channel Campaigns

In its own online store, Leica is initially only focusing on the RRP, but is offering voucher promotions to make prices more attractive. In Q1 2023, for example, there will be a voucher of EUR 1,000 that can be used to purchase Leica kits (camera and lens), but only for the top product series. These have an RRP of EUR 8,200 in the Leica online store, so the voucher corresponds to approx. 12% of the price. It is worth noting, however, that the discount can also be redeemed when purchasing from off- and online specialist retailers, where the same kit is available for EUR 6,400. The discount therefore increases to almost 16%. The EUR 5,400 paid when using the voucher and buying from the best price retailer even offers a reduction of 34% compared to the RRP.

1000 Euro voucher campaign from Leica (leica-camera.com)

Customer perspective: Leica is a premium brand that is not defined by price discounts. Buying the brand’s top products at a price of 2/3 of the RRP is an attractive option with an absolute price advantage of EUR 2,800. This strategy is particularly exciting from the customer’s point of view because the voucher can also be redeemed at specialist retailers. So it’s not just about a hidden reduction in the RRP, but simply about a strong incentive to buy.

Assessment from the manufacturer’s point of view: Leica addresses a high-quality target group with high purchasing power. The customer acquisition costs in such premium markets are high. The voucher provides Leica with the e-mail addresses of buyers. Redeeming the voucher also allows Leica to identify which customer has purchased which product, even if this was done at a specialist retailer. This, in turn, can be used to promote the registration of the products and the use of the Leica account, i.e. to enter into a direct relationship with the customer that can be shaped by Leica. For Leica, this type of campaign is therefore also a vehicle for a successful answer to the second question highlighted in this article: ways to motivate the creation of a customer account.

Another important advantage for Leica is the direct involvement of specialist retailers, who benefit from the voucher. Such voucher concepts also offer manufacturers various models for involving specialist retailers, e.g. voucher costs can also be shared with the retailer or only designated, certified retailers may work with the vouchers. In this sense, the Leica campaign is also an option for involving specialist retailers.

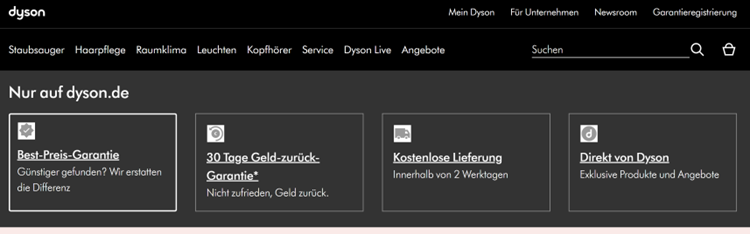

Dyson: Best price guarantee

Dyson offers its customers a best-price guarantee: if the customer is able to purchase a Dyson product from a Dyson retailer at a demonstrably lower price within seven days of purchase, Dyson will pay the difference. Specialist retailers include off- and online retailers, including big box retail partners such as MediaSaturn.

Best price guarantee from Dyson (dyson.de)

Customer perspective: Thanks to the Best Price Guarantee, customers can rest assured that they will not risk any price disadvantages when buying directly from Dyson. All they need to do is search for the best price. However, the question remains as to why the customer, having found the best-price retailer – which will often happen before the purchase, not in the seven days afterwards – does not buy directly from the retailer, but should go back to the Dyson webshop. There is no real motivation for this.

Assessment from the manufacturer’s point of view: The best price guarantee creates price attractiveness without necessarily having to run price campaigns in advance. Even when guaranteeing the best price, Dyson is also likely to achieve a higher margin than when selling via the dealer, as no dealer margin has to be taken into account.

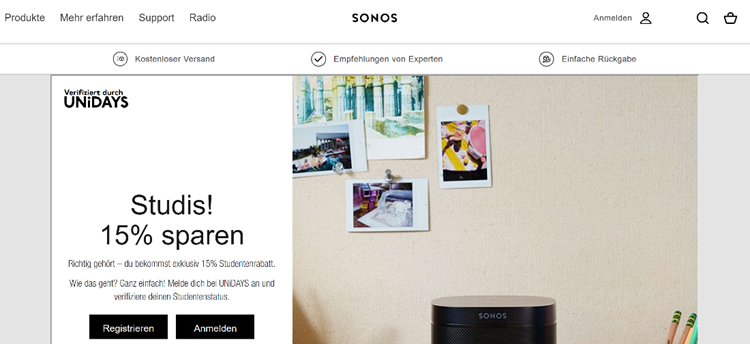

Sonos and Bose: student discounts

Sonos and Bose offer students a flat-rate price reduction. Sonos offers this reduction as a flat-rate discount of 15%. Bose offers an absolute discount of 25 EUR for purchases over 100 EUR.

Student discount from Sonos (sonos.de)

Student discount from Bose (bose.de)

Customer perspective: Sonos and Bose are premium brands that are likely to be very expensive for many students despite the discount. It can be assumed that best-price retailers will also undercut these discounts, at least temporarily. Nevertheless, this campaign offers the first options for entering the respective product worlds and sends a clear signal to the target group that they are particularly important to Sonos and Bose.

Assessment from the manufacturer’s perspective: As premium brands, both manufacturers rely on long-term customer relationships. Due to the system concept, this is particularly true for Sonos. The student discount gives both brands the opportunity to start and form the desired customer relationships at an early stage.

1.2 Services

Differentiation through services has always been a desire of many manufacturers. This differentiation is often perceived as a matter of course. It is therefore surprising how difficult it is to name truly outstanding service offerings and how many services offered by manufacturers ultimately do not even reach market standards. Overall, the successful use of services to build an attractive e-commerce business is clearly less common than the options for price attractiveness shown above.

Sonos: telephone sales advice and virtual showroom

Sonos bietet sehr komplexe Produkte, die sich technisch permanent weiterentwickeln (was sich auch in den verschiedenen Produkt-Generationen wiederfindet) und vielfältig kombinierbar sind. Deshalb bietet Sonos die Möglichkeit, sich als Kunde direkt und telefonisch zur richtigen Produktauswahl beraten zu lassen. Diese Beratung kann mit dem virtuellen Showroom von Sonos verbunden werden.

Sonos Live- Experts (sonos.com)

Assessment from the customer’s perspective: Sonos fulfills an intrinsic customer expectation with its telephone sales advice: No one should be in a better position to advise on their own products than the manufacturer itself. This replaces a visit to a stationary specialist retailer in terms of content and is therefore superfluous or the visit to the specialist retailer can at least be better prepared and followed up.

Assessment from the manufacturer’s point of view: Advising customers directly has various advantages for Sonos, 1) the opportunity to generate sales directly via its own web store – but only if there are attractive price offers there, 2) supporting the purchase from stationary or online retailers, especially if the prices offered there are better, and 3) the opportunity to build up a formable relationship with interested customers. The major disadvantage of consulting in a brick-and-mortar store is the lack of a follow-up option: the local consultant invests his time and expertise in advising the visiting customer, but loses contact as soon as the customer leaves the store. Sonos’ telephone consultation can solve this problem if the customer’s marketing consent is obtained during the call.

Extended return periods and warranty periods

It is noticeable that manufacturers often set their online customers more generous deadlines for returns and warranty periods than required by law. A return period of 30 days after purchase and a warranty period of two years after purchase are required by law.

Examples of extended return periods are:

- Sonos, 100-day return policy

- Bose: 90 days right of return

- Philips: 45 days right of return

Examples of extended warranty periods are:

- Selected Philips devices, but only for buyers with an active My Philips customer account. For these appliances, the warranty is extended by a further year to a total of 3 years

- AEG offers a warranty of 5 or even 10 years on selected products and parts, such as washing machine motors.

- Some manufacturers, such as AEG, offer the option of purchasing longer warranty periods.

Assessment from the customer’s perspective: Return periods and warranty periods are probably less important as a factor in the purchase decision than price – but they are still a factor! This is why these approaches help manufacturers to differentiate themselves from retailers.

Assessment from the manufacturer’s perspective: Manufacturers who allow longer return periods must be prepared for two things: A greater proportion of returns and a greater degree of wear and tear on returned goods. Manufacturers can counteract this, for example, by using their own e-commerce for the sale of B-goods and through production geared towards the circular economy, i.e. the reusability of parts.

Unfortunately only an option in theory: delivery and installation services

Delivery costs are a key criterion for customers when making a purchase. The same applies to appliance installation, especially for large household appliances. Many manufacturers therefore emphasize their delivery and installation services on their webshops.

Examples of delivery services:

- DJI: Free delivery for orders over EUR 119

- AEG: Free delivery to the kerbside

- Bosch: Curbside delivery for EUR 34.99

Examples of installation services:

- AEG: EUR 29.99

- Bosch: 59,99 EUR

Assessment from the customer’s perspective: Unfortunately, these services are not competitive from the customer’s perspective. Free delivery is standard, at least with the top dog, Amazon Prime, and is also combined with very short delivery times. An AEG washing machine can also be installed directly for EUR 10 when purchased via Amazon.

Assessment from a manufacturer’s perspective: Manufacturers need to become more aware of the importance of attractive delivery and installation services for purchases and set up corresponding infrastructures or develop them together with partners. It is important to keep in mind that the total price is what counts for the customer in the end, i.e. the sum of the purchase price, delivery and installation costs.

1.3 Product exclusivity

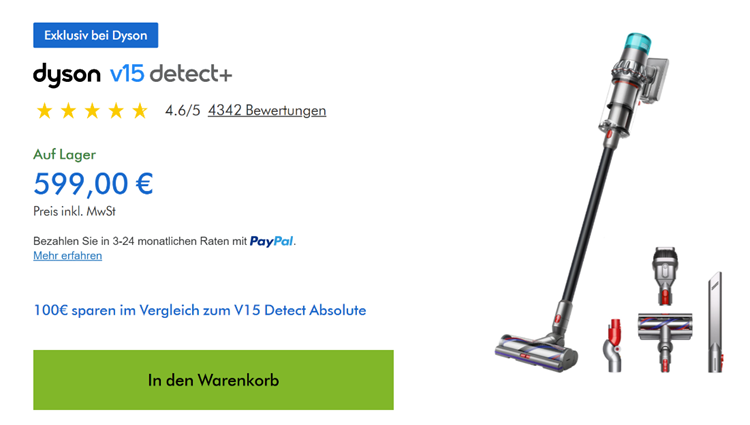

Dyson: Exclusive products and bundles

Another option for manufacturers to differentiate their own online store is to offer exclusive products that are only available in their own online store and not – or not yet – in stores.

Two examples of this can be found at Dyson: some product lines, typically new products or product innovations such as the Dyson V15 Detect+ vacuum cleaner, are only available online and directly from Dyson. Dyson also offers bundles, i.e. combinations of products, or certain product colors only in its own web store.

Canon offers another example, also for new products, but in a different form: New cameras can be pre-ordered online from Canon.

Dyson V15 Detect+ vacuum cleaner (dyson.de)

Assessment from the manufacturer’s perspective: Exclusive products are aimed at two different target groups, brand fans and price-conscious customers. For brand fans, these exclusive products offer functional advantages and emotional benefits. The advantage of pre-ordering new products can be seen at Canon, for example, in the fact that some new cameras are sold out immediately after their market launch. And from an emotional point of view, it will be something special for brand fans to be able to buy exclusive products directly from the brand and thus stand out from the standard consumer.

Price-conscious customers, on the other hand, are likely to be particularly interested in the exclusive bundles and the price advantages they offer.

Manufacturer’s assessment: Marketing and distributing product innovations only via its own (in this case digital) sales channels offers the manufacturer several advantages. Firstly, a product experience on their own channels that is fully controllable from a brand perspective and can be ideally designed using their own content expertise, which can also serve as a central landing page for online marketing measures. And secondly, direct monetization without the need to pay a retailer margin. Exclusive bundles offer the manufacturer the opportunity to provide customers with attractively priced offers without entering into visible, direct price competition with its dealers.

2. Added value of customer accounts of the manufacturer webshops

In order for manufacturers to exploit the potential of a D2C strategy, it is essential to establish direct relationships with their own customers. Online customer accounts are a key function for this. Manufacturers have been pursuing the goal of a direct, digitally configurable relationship with customers for some time, often well before the launch of their own online store. These customer accounts are now becoming particularly important for the success of their own web stores, as their ability to communicate directly with customers offers manufacturers the opportunity to actively shape a high, long-term customer lifetime value at low marketing costs.

But how do manufacturers get customers to create an account? Below we present three typical added values that manufacturers offer their registered customers:

- Extended warranty with product registration

- Discounts for customer registration

- Status-dependent, exclusive services

2.1 Extended warranty with product registration

Premium manufacturers of electronic devices in particular grant customers extended warranties in order to better express the quality of the products at the time of purchase and to offer an additional value proposition compared to manufacturers of cheaper alternatives. These extended warranties can also be redeemed with the manufacturer after purchase from a retailer – by registering the products and setting up a customer account.

Leica and Philips, for example, extend the manufacturer’s warranty by one year, i.e. to a total of three years. Bosch even grants a 10-year warranty on the motor for vacuum cleaners upon registration. Dyson, on the other hand, also uses the manufacturer’s warranty as a vehicle to incentivize customer accounts – but without adding additional years to the warranty. This is because if Dyson customers want to receive the manufacturer’s warranty, which is required by law anyway, they must also register the product. Account registration is therefore purely out of necessity, but offers no original added value of its own.

Assessment from the customer’s perspective: The option to extend the warranty free of charge simply by registering the product should be very interesting for many customers. The customer account is created as a necessary basic requirement – but it still has to earn its right to exist, especially as a communication platform for the exchange between manufacturer and customer.

Assessment from the manufacturer’s perspective: Warranty extensions are a good way for manufacturers to generate customer accounts cost-effectively, as customers who have purchased the product from the retailer also register directly with the manufacturer. For the manufacturer, this offers the opportunity to make future offers directly to the customer, to generate customer lifetime value and to do so without high customer acquisition costs, as these are borne by the retailer. The manufacturer only had to draw the customer’s attention to the extended warranty offer, for example via their own online channels, which the customer often visits as part of their purchase decision, or through package inserts.

2.2 Discounts for customer or product registration

Another incentive for creating a customer account is the offer of discounts. One example is AEG: customers receive a 25% discount on accessories purchased online from AEG as a thank you for registering a product and setting up a customer account. Again, this function can also be used for products purchased from retailers. At GoPro and Stihl, new customers can also receive a discount on their next order. GoPro gives a 10% discount on the next purchase in its own online store and Stihl gives a EUR 15 discount if new customers have previously subscribed to the newsletter.

Some manufacturers also offer their customers discounts linked to customer registration in the form of a cash back program: Registered customers receive a certain percentage of their purchase value obtained directly from the manufacturer’s webshop as a voucher that can be redeemed in the store. As with all discount programs, the attractiveness depends primarily on the amount of the cash back. A well-known manufacturer of drones, for example, offers its customers a cash back value of 1% – this value is so low that the manufacturer should actually be advised to discontinue the cash back program in this form.

Assessment from the customer’s perspective: Such discounts can be very interesting for customers – but only if they are sufficiently high. Some of the discounts offered are so small that you have to ask yourself whether these promotions are not even irritating and negative from the customer’s point of view.

Assessment from the manufacturer’s perspective: For manufacturers, such discount offers are a relatively simple means of generating customer accounts. However, for this to work, the discounts must be sufficiently high. The possibility of counter-financing by redeeming the voucher in your own webshop speaks in favor of sufficiently high discounts. If the customer registers the product purchased from the retailer, the knowledge about the customer, who was previously unaware of the manufacturer as a product owner and user, is also expanded.

2.3 Status-dependent, exclusive services

Another way to convince customers to register is to offer status-dependent, exclusive services. This model is standard in many industries, such as airlines. Manufacturers also use such status programs to build long-term customer relationships. At Nespresso, for example, buyers can achieve three customer statuses:

- Connoisseur: as soon as the customer registers, they can order free shipping (from 10 bars or EUR 40 order value), take part in Master Classes and receive machine services.

- Expert: Customers who have been members for five years or who purchase over 1000 capsules per year also receive a descaling voucher for the purchase of 1300 capsules, a 10% discount on accessories, as well as access to pre-sales.

- Ambassador: If customers have now been members for ten years or purchase over 1300 capsules per year, they receive a premium delivery service (from 20 bars of coffee or an order value of €80), take part in the VIP sale and receive a 30% discount on machines.

Nespresso membership status (nespresso.co.uk)

Assessment from the customer’s perspective: Capsule machines such as those from Nespresso require the constant purchase of additional capsules. Loyalty-rewarding customer loyalty programs are also obvious from the customer’s point of view in this situation; they are also familiar to him, for example, from airline or train programs. However, the competitiveness of the benefits of the Nespresso customer loyalty program are at least partially questionable. Why is a comparatively high minimum order amount required to get the capsules delivered for free when this is standard with Amazon Prime? Why do I get a descaler as a thank you for buying large quantities of premium-priced coffee capsules, which I can buy for a few euros in any supermarket? The machine discount is also much lower than the discount that a status customer would receive anyway with a Nespresso subscription, which we presented earlier.

Assessment from a manufacturer’s perspective: Status programs sound tempting from a manufacturer’s perspective. However, manufacturers must be aware that status programs only make sense for customers if the included benefits really make a difference and are exclusive. Offering a bundle of benefits that are standard elsewhere makes no sense and is likely to come to nothing in the long term.

3. Cooperation with dealers

The better the value proposition of manufacturers’ online stores becomes – and this is exactly what we want to provide inspiration for in this analysis – the more difficult the expected dialog with existing retailers, who have often taken over the distribution for brand manufacturers completely and have played an essential role in the manufacturer’s success. Manufacturers and retailers are now competing for the customer. However, the manufacturer must continue to work with the retailer, as direct sales are small compared to existing retailer sales, especially at the beginning of the implementation of a D2C strategy. In the following, we present three ways in which manufacturers try to integrate retailers into their e-commerce activities. However, it is necessary to look closely at the real benefits for customers in each case – and therefore also the usefulness for manufacturers and retailers.

- Retailer search (stationary retailers)

- Retailer linking (online retailers)

- Exclusive retailer products

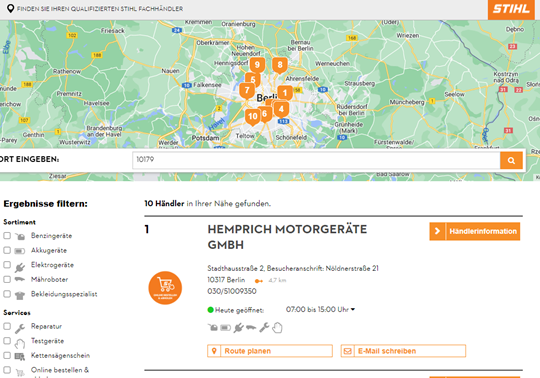

3.1 Dealer search (stationary dealers)

At first glance, the simplest solution in the competition between manufacturer and dealer is to give the customer the choice on the manufacturer’s webshop whether they want to buy directly from the manufacturer or from the dealer.

Stihl, for example, offers a search for stationary dealers on its own webshop. By entering their zip code, customers can see a list of dealers in the area where Stihl products are available. This list can be filtered according to product range groups and services available from the dealer. Basic information, such as address and opening hours, is displayed for each dealer.

Dealer search from Stihl (sthil.de)

Customer assessment: For the customer, searching for brick-and-mortar retailers as an alternative to buying from the manufacturer’s online store only makes sense to a very limited extent and only in special cases.

For the customer, the search for a stationary retailer initially means additional work: searching for a retailer in the vicinity, checking product availability and price by telephone, traveling there and collecting the goods. For most customers, this is probably too inconvenient to cancel the purchase from the manufacturer – unless the customer needs the product immediately and hopes to be able to pick it up nearby in a timely manner.

Manufacturer’s assessment: By integrating the search for stationary retailers, the manufacturer can present itself to its retailers as a collaborative partner. Realistically, however, in most cases this integration is more of a symbolic collaboration: where no value can be offered to the customer, no value is created for the retailer.

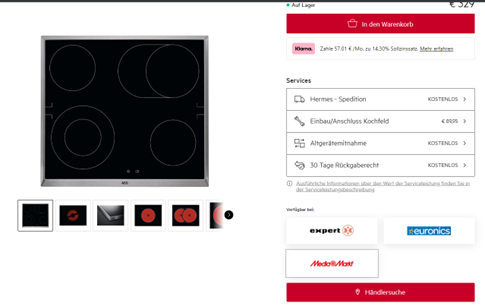

3.2 Retailer linking (online retailers)

Instead of the search for stationary retailers presented above, some manufacturers also include online retailers. AEG, for example, offers links to online retailers where the product is available on the product detail pages of its own web store in addition to the “add to basket” function. The links lead directly to the product page of the respective online retailer.

Online dealer link from AEG (aeg.de)

Assessment of the customer: From the customer’s point of view, this function is probably particularly valuable because it creates an incentive to compare prices. However, this function is not particularly convenient from the customer’s point of view because they have to work their way through each connected online retailer’s webshop separately. This can quickly feel tedious, especially if the first price differences found between the manufacturer and retailer are so high that the search for the best price seems necessary – in this case, price comparison platforms such as idealo.de quickly offer help.

Manufacturer’s assessment: From the manufacturer’s point of view, the option of linking to online retailers is ambivalent: You do help the customer to find the best option and also the best price and even involve the retailers in the process – but all at the expense of a tedious customer experience. And if the customer actually finds more attractive prices at online retailers, the manufacturer’s online store is no longer the first choice for subsequent purchases, at least for this customer.

3.3 Exclusive dealer products

Manufacturers can offer their dealers exclusive products that only these – possibly selected and certified – dealers are allowed to sell, not the manufacturer itself.

Bosch, for example, has an EXCLUSIVE home appliance program: Selected partner dealers sell the EXCLUSIVE range exclusively through stationary retailers. There is also a solution for furniture stores and kitchen studios. The Accent-Line range is available exclusively from kitchen and furniture retailers.

JBL takes a similar approach with its Premium Audio segment, which is only sold through specialist retailers.

EXCLUSIVE home appliance program from Bosch (bosch-home.com)

Customer assessment: For customers, this integration of specialist retailers is particularly useful due to the complexity of the products: customers benefit from the on-site advice and services of specialist and partner retailers. This is especially true for customers who place particular value on quality and personal advice and are less price-sensitive.

Manufacturer’s assessment: Manufacturers can use this model above all to maintain and expand their cooperation with specialist and specialty retailers who are experienced in providing products and advice. The exclusive dealer products are usually more expensive and allow good margins for dealers and manufacturers. On the other hand, the manufacturer can then sell all other products, which probably account for the majority of sales, competitively themselves, as the dealers who focus on the exclusive products are no longer in competition.

4. Conclusion

Manufacturers must give their own D2C webshops value propositions that set them apart from competing retailer webshops. Manufacturers must also offer their customers sufficient added value to successfully establish their customer accounts. To do this, manufacturers use a broad mix of approaches that aim to offer attractive prices and special services. These approaches are sometimes offered separately and sometimes in combination.

Although manufacturers have fewer conceptual options than retailers when it comes to price attractiveness – for example, the manufacturer may not permanently deviate from its own RRP – there are ways to make prices indirectly attractive, e.g. through temporary promotions, voucher campaigns or exclusive product bundles. In the area of services, on the other hand, manufacturers have more options than retailers, for example through subscription models or combining the purchase of hardware with digital services from the manufacturer. In addition, manufacturers can – and must – also offer services that are part of the e-com standard for retailers, such as delivery and installation services.

One overarching finding is that the configurative characteristics of the conceptual approaches of many manufacturers are still too small: For example, the delivery and installation services are more expensive than Amazon’s, the voucher campaigns are insufficient to compete with the idealo best price and the loyalty programs do not offer any independent added value. It is striking that comparatively young manufacturer brands such as GoPro or Sonos, which are virtually “digital native brands”, focus their web stores much more consistently on attractiveness than established manufacturers such as Bosch, Miele or Philips.

An important question for established manufacturers in particular is how they can build their own attractive webshops without attacking their long-standing retail partners and their e-com strategies. Many manufacturers are therefore also trying to integrate their retailers’ webshops into the manufacturers’ webshops as an alternative purchasing option. However, these approaches make no sense, at least from the customer’s point of view – and will therefore not work for either the manufacturer or its retailers. Manufacturer campaigns that integrate the retailer, such as those from Leica, seem more promising.

Brief portrait & contact – eStrategy Consulting

eStrategy Consulting helps clients to use digital innovations to further develop existing business models and create new business opportunities. We support the retail industry in its further development towards omnichannel and connected commerce and our clients include manufacturers, traditional big box retailers, the retail real estate industry and digital marketplaces and platforms.

eStrategy Consulting covers the entire life cycle of digital innovation, from analysis to ideation, solution development and market launch. We work as strategy and concept developers as well as seamlessly integrated and pragmatic implementation managers. We rely on a mix of methods from the world of digital business and traditional management consulting. The focus is on our clients’ customers as well as their organization and the skills required to operate it.