Digital business models for Deutsche Bahn in the context of WIFI@DB

Case Study

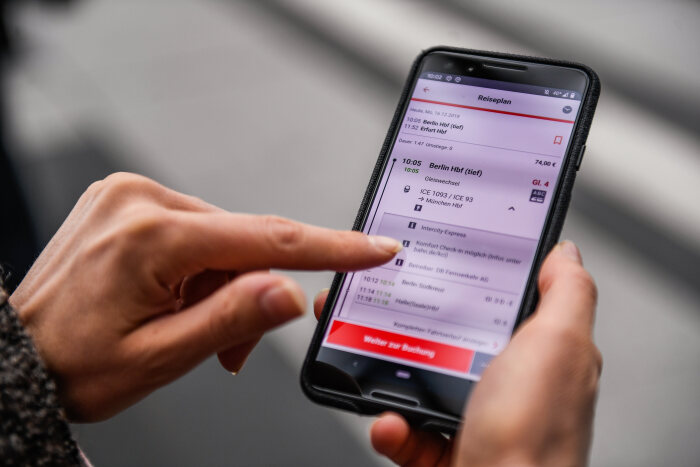

„Mit WIFI@DB werden unsere Züge noch ein Stück mehr zum verlängerten Wohnzimmer oder zum mobilen Büro. ‚Seamless connectivity‘ bedeutet mehr Komfort für Pendler und Geschäftsreisende, die im Zug, am Bahnhof und der DB Lounge durchgängig surfen können und sich auch für die Rückfahrt nicht erneut einloggen müssen.“

Objectives

For the federal government as the owner of Deutsche Bahn, the goal was to improve the digital infrastructure and increase customer benefits in the area. For Deutsche Bahn, the goal was to cover the investments as far as possible with revenues based on this digital infrastructure.

Solution

During project planning, particular emphasis was placed on the design of different piloting concepts. In response to the question of creating an adequate basis for decision-making for the complex company Deutsche Bahn, with very many contact points and channels for millions of customers, a convincing solution was worked out by consolidating the various pilot approaches.

Results

In the first phase of the project, we focused on creating a study of free WLAN projects in Germany. In a further step, we created an overview of infrastructures and pilot concepts within Deutsche Bahn. Based on this, a targeted and extensive preparation of the tender for the technical implementation of WIFI@DB was required, which we led. This was followed by the evaluation and presentation of more than 20 business models for refinancing WiFi@DB. The final implementation of the WLAN project took place in September 2020. Today, WIFI@DB is the largest free WLAN network in Germany and based on this, different services are offered to the customer.

Related Studies and Articles

Study: German manufacturers’ perspective on the topic of D2C

How do German manufacturers of high-interest products view the topic of direct-to-consumer? What motivates them, and what challenges are decision-makers in marketing and sales organizations facing? And how relevant will D2C be for them by 2030? Our latest D2C study answers these questions.

Interview: Strategy and digitalization in associations

The strength of associations lies in the diversity and creativity of their members. But how can this potential be made visible digitally and successfully leveraged collectively? Our Managing Partner Thomas Natkowski discussed these questions in an interview with Platoyo.

Learn more about eStrategy Consulting

We are proud of our satisfied customers, our extensive project portfolio and our rehearsed team.