Study on local marketplaces & opportunities for brick-and-mortar retail [Update 2022]

Hinweis: Für eine bessere Darstellung sind einige Elemente der Seite in der mobilen Ansicht ausgeblendet. Für eine vollständige Ansicht inkl. Diagramme empfiehlt sich die Ansicht auf einem Computer oder Tablet.

Initiatives for stationary retail

The heart of a typical medieval European city is its marketplace, where goods were traded, information was exchanged or social contacts were maintained. The marketplace was where economic life took place, where supply and demand came together. To this day, a lively and diverse city center is important for the attractiveness of cities – this applies to both residents and visitors. Today, the cityscape is dominated by restaurants, service providers and retailers. Stationary retail is particularly important, with around 320,000 locations, while gastronomy, with around 124,000, has only about half as many locations.

However, stationary retail has come under pressure and there is occasional talk of a “store death”. There are various reasons for this trend: If it was initially the shopping malls that often drew demand to the outskirts of the city, in the past ten years it has been primarily the Internet that has been competing with stationary retail as a whole. It is not only the retail sector itself that is looking for solutions; cities and municipalities are also trying to promote local retail and thus maintain attractive and livable city centers. Various measures are being used to achieve this:

- Regulations against the establishment of “downtown-relevant product ranges” on the outskirts of the city or on “greenfield sites”

- Promotion of business locations in the city centers including a suitable infrastructure

- City marketing and promotion of demand in the stationary retail sector, for example through events in the city centers or marketing

Increasing digitization also plays a role in promoting stationary trade. Some chambers of industry and commerce (IHK) offer training for retailers, for example. Furthermore, cities and, in some cases, advertising associations of local retailers are endeavoring to generate visibility for the stationary offering on online channels in order to retain local purchasing power as a result. These initiatives range widely – from WhatsApp groups to local online marketplaces. The Corona-related store closures in parts of the retail sector have further accelerated this development and led to an unmanageable variety of initiatives to promote local trade.

Some of these initiatives have been supported by substantial federal or state funding, and many have been launched through the spirited commitment of local stakeholders. Very few of these initiatives, however, have succeeded in creating a lasting impact or persisting after the pandemic has subsided.

The study by eStrategy Consulting covers various initiatives to promote retail in Germany and German-speaking countries. The study makes no aspiration to completeness. Rather, the different approaches are to be categorized, described and evaluated. Based on this, strategies and success factors for stationary retail as well as for local players will be presented.

Beginning with a presentation of the digital solution approaches, the study first provides an overview of various initiatives. The evaluation of the approaches is based on the assessment and experience of eStrategy Consulting, which was supplemented by various interviews with representatives of the initiatives as well as of cities and municipalities, economic development agencies, chambers of industry, commerce associations, and advertising associations of local retailers. In addition, a look was also taken at the activities of established marketplaces and platforms such as Amazon, eBay and Zalando, which have developed offerings for stationary retail.

Non-transactional approaches

Transactional approaches

Fundamentally, initiatives can be divided into transactional and non-transactional approaches. Only a few initiatives offer a transactional solution, i.e., a true online marketplace, even though the term marketplace is often used as a synonym for a large number of these initiatives. The non-transactional “marketplaces” can be divided into pure merchant directories on the one hand and so-called “online storefronts” on the other. These are directories of product ranges which show a selection of products from the respective retailer, but which cannot be purchased online; in the best case, they can only be reserved. The majority of these initiatives are local or regional projects, but there are also some nationwide initiatives. The transactional initiatives are divided into “local and regional online marketplaces” and “vertical online marketplaces”. The latter serves to distinguish them from initiatives that focus only on specific product ranges.

Non-transactional approaches

In this study, we will first look at the category of non-transactional approaches for retailers. The simplest solution here is offered by so-called retailer directories, which are described below.

Retailer directories

Retailer directories are simple online directories that list and present the local retailers of a city or region. They offer retailers the opportunity to achieve a certain visibility on the Internet. In most cases, visitors to these retailer directories will find contact details and opening hours of the retailers, occasionally there are also extended retailer profiles. Usually, a map search is also offered, which shows the locations of the retailers. In case the retailer already has its own website, or even a webshop, a link to these pages is also common.

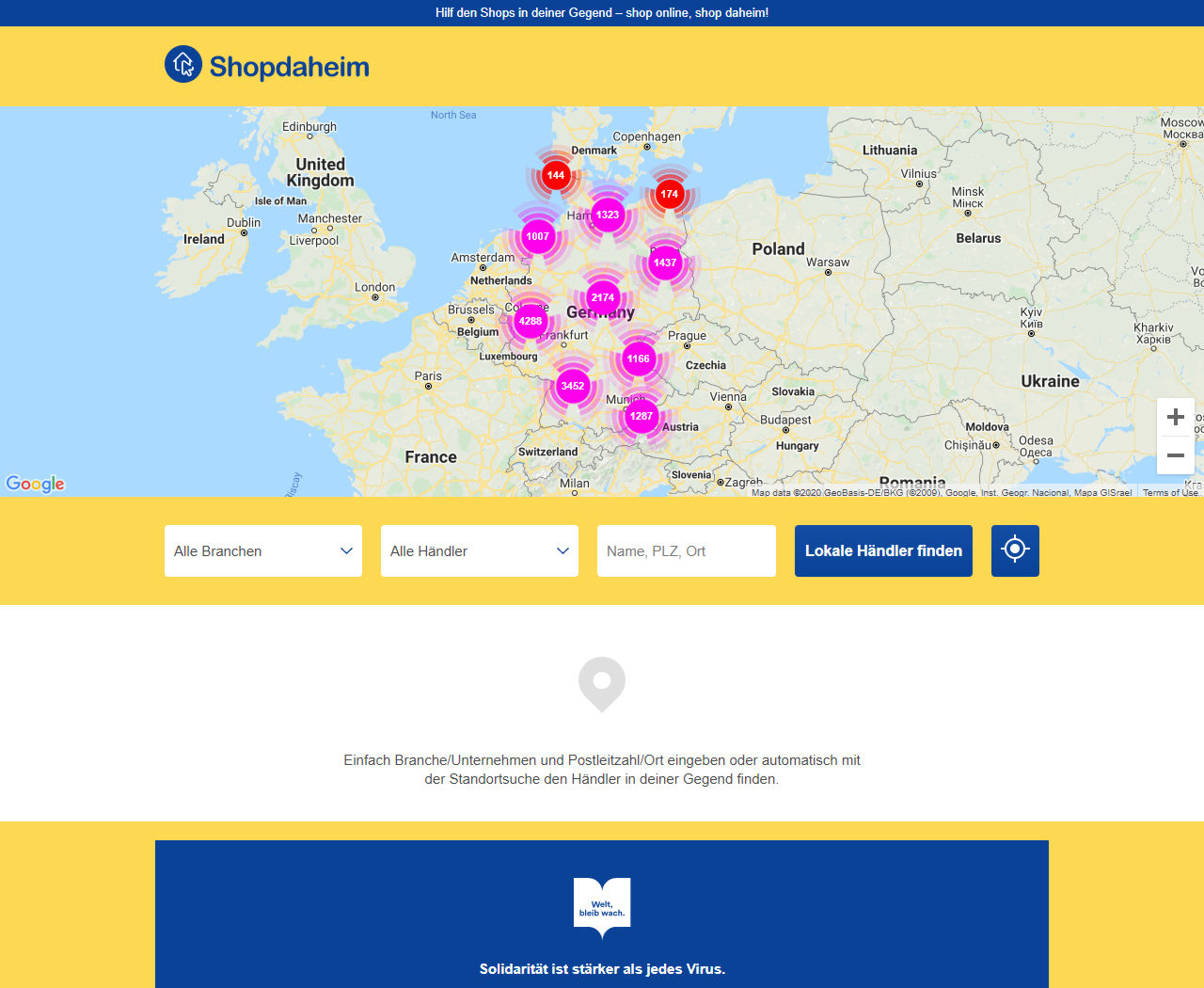

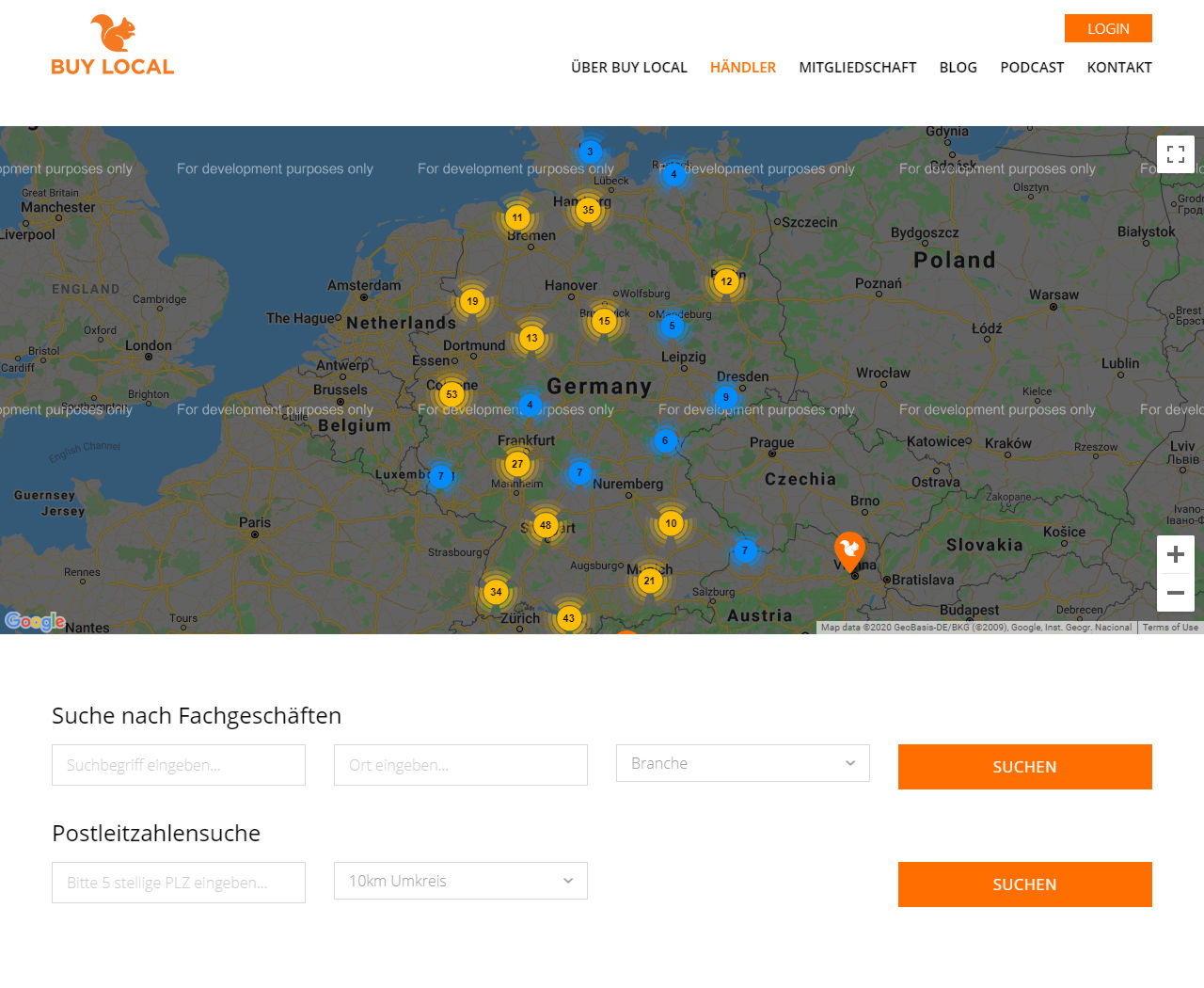

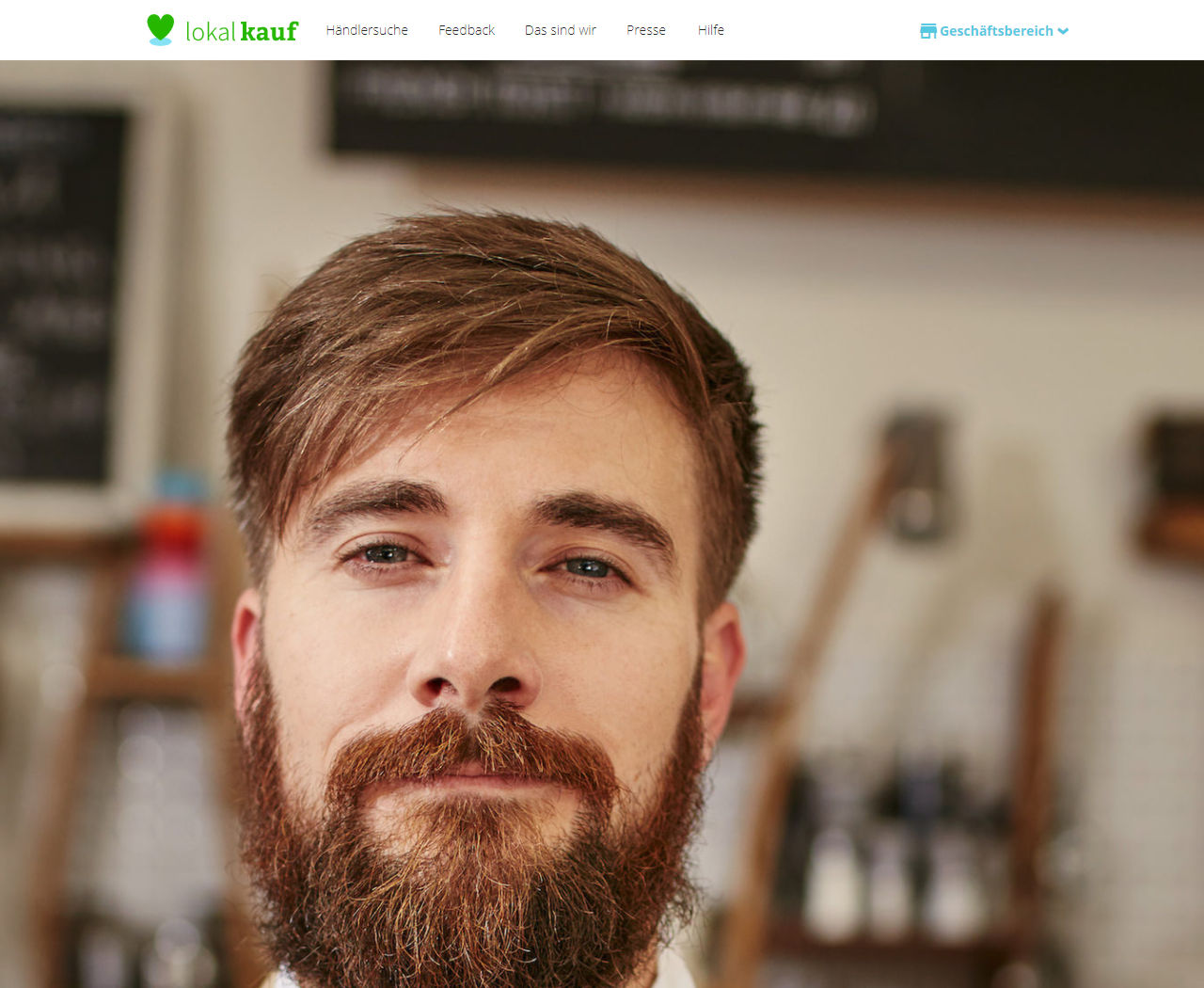

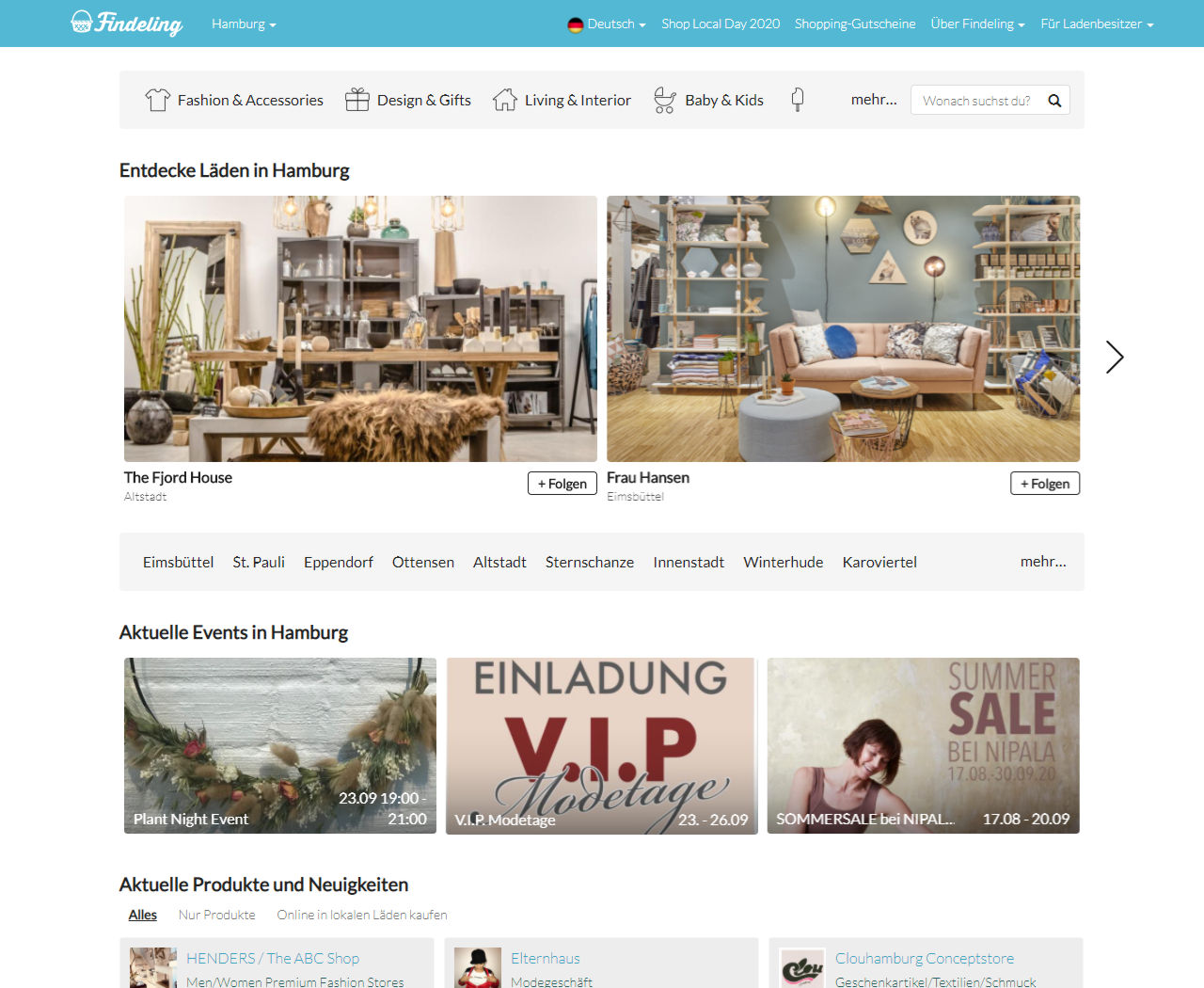

Here there are not only Germany-wide platforms like Buy Local, Lokalkauf or Shopdaheim. There are also countless local initiatives, partly because of Corona, they try to tell the local population which retailers are open or how they can be reached.

Examples of retailer directories (click to enlarge)

Review of retailer directories

A low level of effort on the part of the retailers is therefore also offset by a low level of benefit. The question here is therefore what incentives the directories offer users and, above all, customers. Customers increasingly use options such as Google My Business to find retailers because they do not have an overview of the existence of such small Retailer directories.

Online storefronts (assortment directories)

In the following, so-called assortment directories are defined and evaluated here. They are also called “online storefronts” and display the retailer profiles for a specific city or region (similar to Retailer directories). Links to dealer websites or webshops are also possible. However, they offer the add-on of a dealer-specific digital assortment display. Thus, the basic idea is that customers can get inspired online in the assortment directory by viewing the retailer’s assortment. The customer can then purchase the goods in the stationary retailer on site. Retailers sometimes also offer reservation functions here, so that product availability on site is guaranteed.

Online storefronts are often local initiatives that showcase the products of retailers in a specific city or region. Therefore, local companies are often heavily involved in their design and commissioning. Publishers in particular serve as bases for such projects. One example is the Lieblingsladen platform, which is operated by Südkurier Medienhaus in the Lake Constance region.

Another player in the segment of assortment directories is the shopping center operator ECE, which operates such sites called “Digital Mall” for more than 60 shopping malls. In this project, the assortments of the participating retailers of the respective malls are presented in a shopping area on the center websites. In this way, customers select their desired product at home, carry out an availability check and then pick it up on site at the mall. Alstertal-Einkaufszentrum is currently in a pilot phase that will enable customers to buy products online and have them delivered to a desired location as part of a transactional marketplace.

Examples of online storefronts (click to enlarge)

Review of assortment directories

The assortment-based approach is attractive if either customers can find their way to the retailer’s site and be inspired by the local offering or, on the other hand, the items are marketed in such a way that they can be found by specific product searches by local customers, e.g. via Google. However, this is only true in the rarest of cases, so that a large majority of initiatives, although created with a great deal of effort, rarely achieve any noticeable effects for participating retailers.

Transactional approaches

Local and regional online marketplaces

This section looks at transactional platforms on which local offers and the demand of a city or region are to come together.

While customers can shop throughout Germany on some of these marketplaces, other marketplaces restrict demand locally or to the region, for example by only allowing goods to be picked up. One example of a transactional marketplace that delivers nationwide is Mein Heilbronn Shop. Here, customers can order in the store, by e-mail or by phone and then pick up the goods from the retailer, have them delivered in Heilbronn or even Germany-wide. Flobee represents an example of exclusively local delivery. However, Flobee offers same-day delivery and thus real added value for local customers.

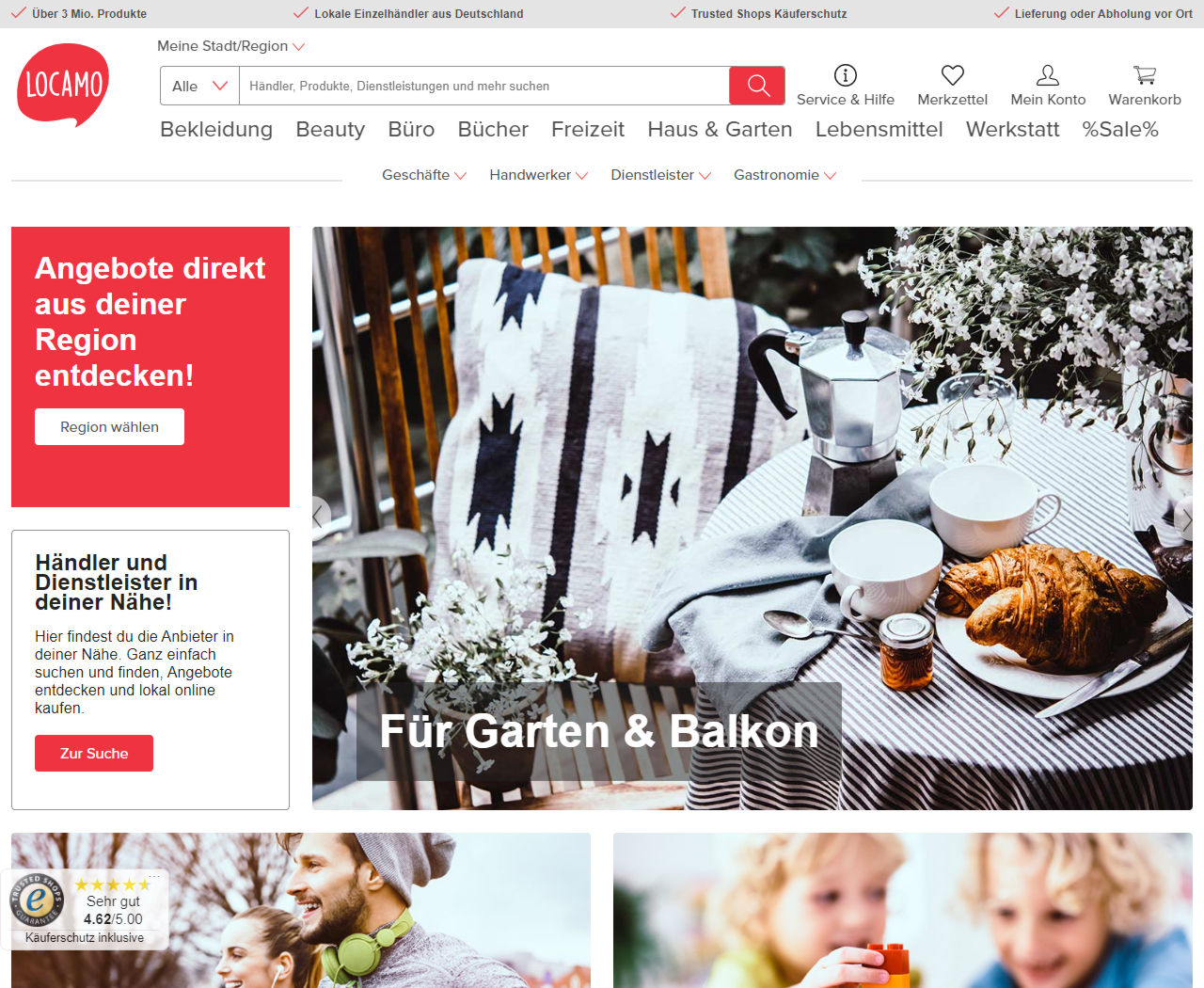

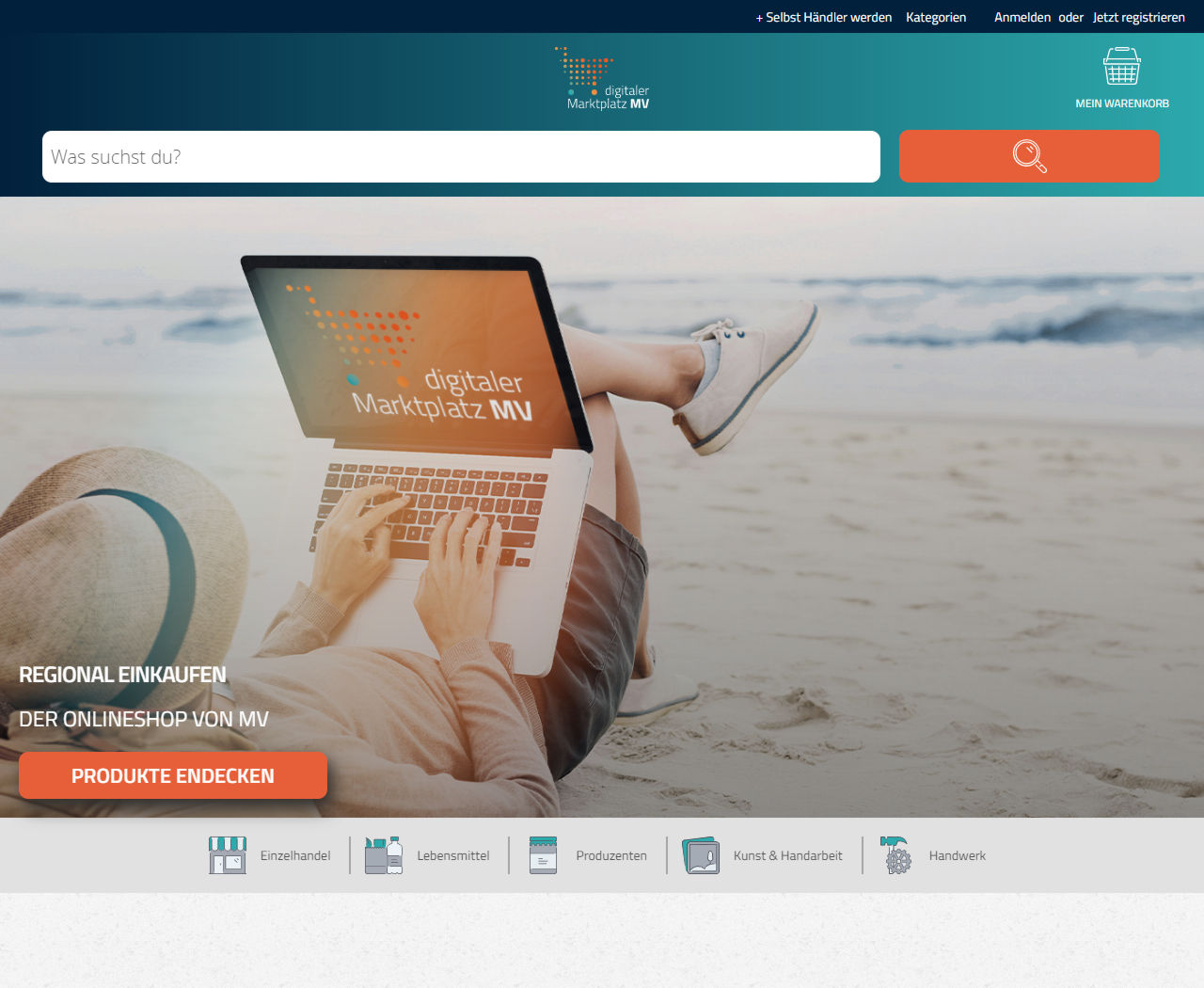

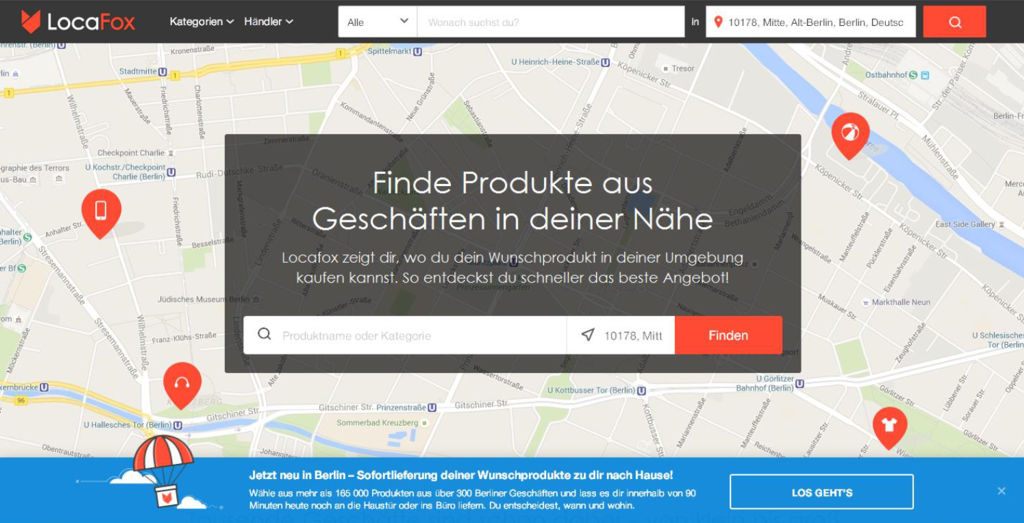

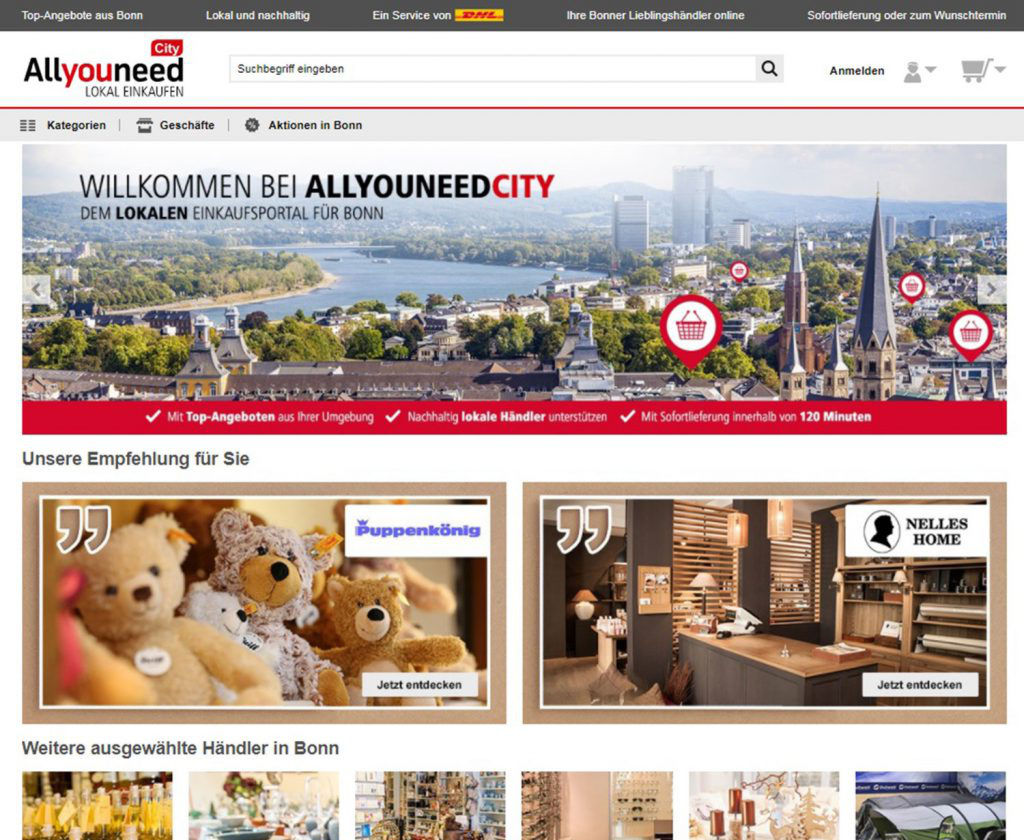

A large proportion of local online marketplaces are based on solutions from commercial providers such as Atalanda , which specialize in selling local marketplaces. This is no coincidence, because installing a transactional platform is significantly more costly than a non-transactional solution. Many local initiatives shy away from this investment. But it’s not an easy market for commercial providers of such platforms either, as the long list of failed providers here shows: Allyouneed, Locafox, SimplyLocal, Locamo, Lozuka and many other players have ceased operations in recent months and years because they failed to develop a business model that works independently of subsidies or municipal grants. For retailers, there is a great deal of effort involved in posting their assortments on these platforms, which are barely integrated into the e-commerce ecosystem, if at all. Moreover, they do not achieve sufficient reach and sales to justify this effort. As a result, there is generally no added value for customers, and after a start-up phase, cities and municipalities generally have to ask

New on the market since April 2021 is the concept “eBay Deine Stadt” (eBay your city), with now more than 30 participating cities and regions. eBay Deine Stadt offers a different concept for a local marketplace with some significant advantages, which explains the great success of the model in the past months. For cities, eBay Deine Stadt offers a fast implementation based on a platform that is connected to the eBay marketplace. Many local retailers from all over Germany are already active here, which facilitates the implementation of a local online marketplace per city, since in many cases a critical mass of merchants and assortment already exists. The most important advantage for the cities, however, is that the eBay Deine Stadt model is attractive to retailers, making the approach a sustainable model for a local online marketplace. On the one hand, sellers work with an established platform (ebay.de), where they find additional reach and local visibility in a local online marketplace. In addition, new sellers find extensive support in the first few months as part of the “eBay Durchstarter” program.

The special approach of “eBay Deine Stadt” is also shared by experts in the market:

I have observed many attempts to establish local online marketplaces in recent years. And almost all of them have failed. After one year of ‘eBay Deine Stadt’ and a look at the numbers, it looks like this initiative is a positive exception. In my view, the decisive factor for success is that eBay already has a critical mass of merchants with their goods and a large customer base. At the same time, current crises and customer expectations are increasing the pressure on brick-and-mortar retailers to look for additional digital sales channels. Online marketplaces like eBay offer a comparatively fast and uncomplicated entry. eBay Deine Stadt” gives retailers additional local visibility.

Our HDE consumption barometer fell for the sixth month in succession in May and has now reached a record low. The war in Ukraine, the consequences of the Corona pandemic and inflation are putting a massive damper on consumers’ spending mood. This is hitting many small and medium-sized retailers particularly hard. They are therefore dependent on additional sales channels as well as on more visibility for their offers, especially digital visibility. The ‘eBay Deine Stadt’ project offers all this and is therefore an important support for local retail companies.

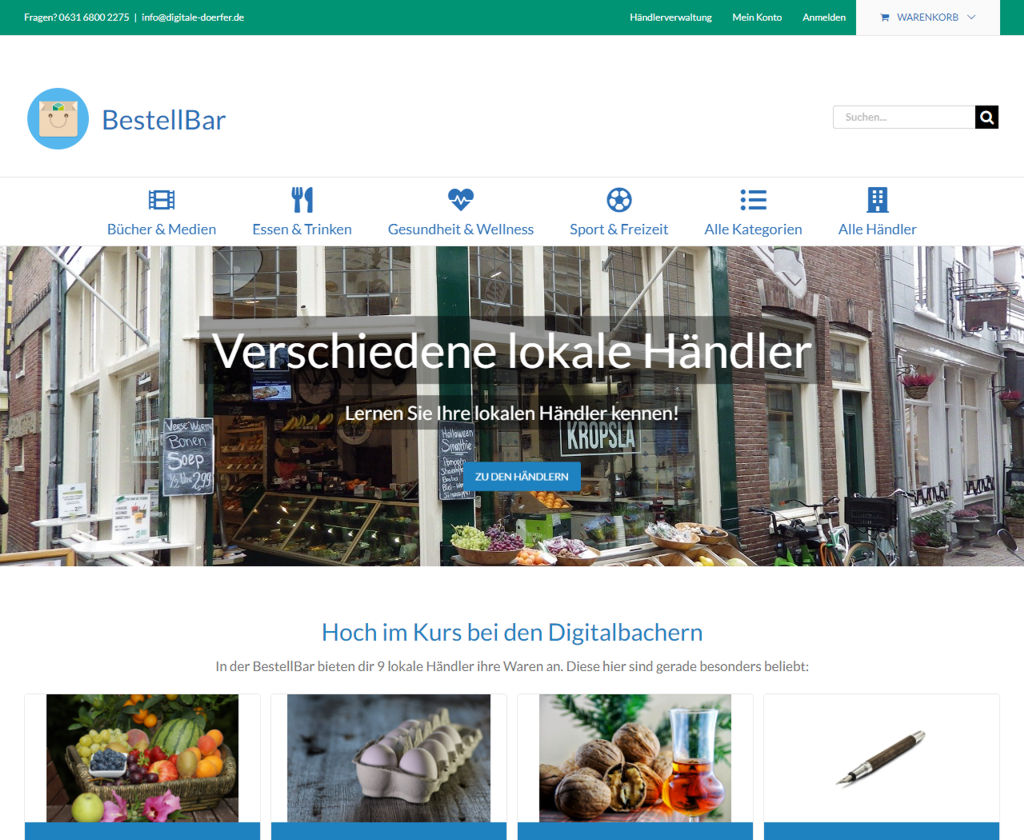

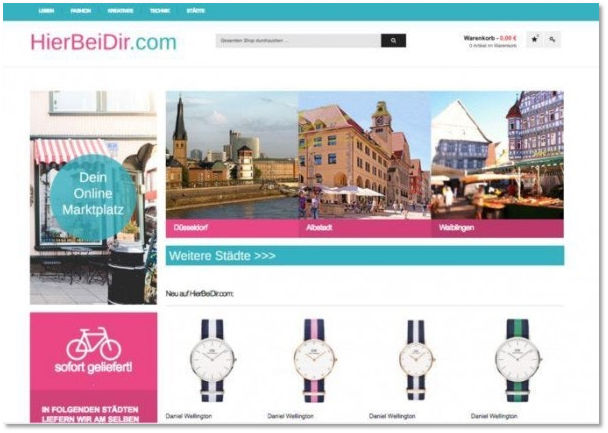

Examples of local and regional marketplaces (click to enlarge)

Review of transactional local and regional

The implementation of local online marketplaces represents a significantly higher effort than non-transactional solutions. For this reason, solutions from commercial providers are more likely to be found than individual municipal developments. Listing and settlement processes also represent a higher expense for retailers, which is generally not covered by the low demand. In the past, this has led to the failure of even ambitious projects with prominent partners such as the following. eBay’s approach is an exception here, as merchants can combine the wide reach of the eBay marketplace with the local online marketplace under “eBay Deine Stadt”.

Examples of failed platforms (click to enlarge)

„A true regional marketplace contradicts the basic idea of a marketplace and therefore cannot work, because it is purely about reach. All city-based online marketplaces have failed or will fail in the future.“

To learn more about digitization in the German retail sector, read our interview with Prof. Heinemann: Economist Gerritt Heinemann on how stationary retailers can finally move the needle on digitalization.

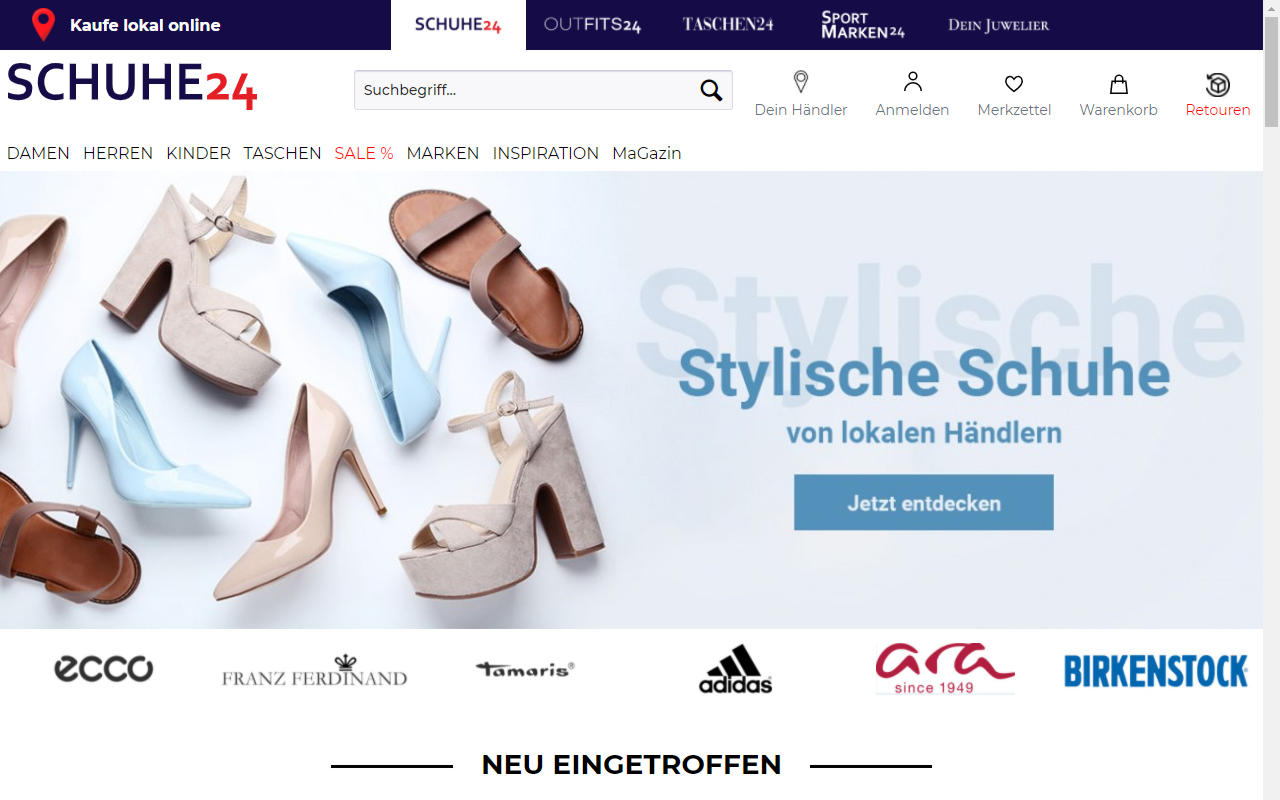

Vertical online marketplaces

In this study, we can’t overlook the marketplaces of composite groups or vertical aggregators. These are among the vertical approaches and tend not to be operated by cities or municipalities. The aim is not to promote the stationary trade in general, as in the previously mentioned categories, because trade associations usually only support the members or participating partners of the composite group. The fact that the stationary partners are no longer visible, but part of a centralized online model of the composite group could be a problem in this case.

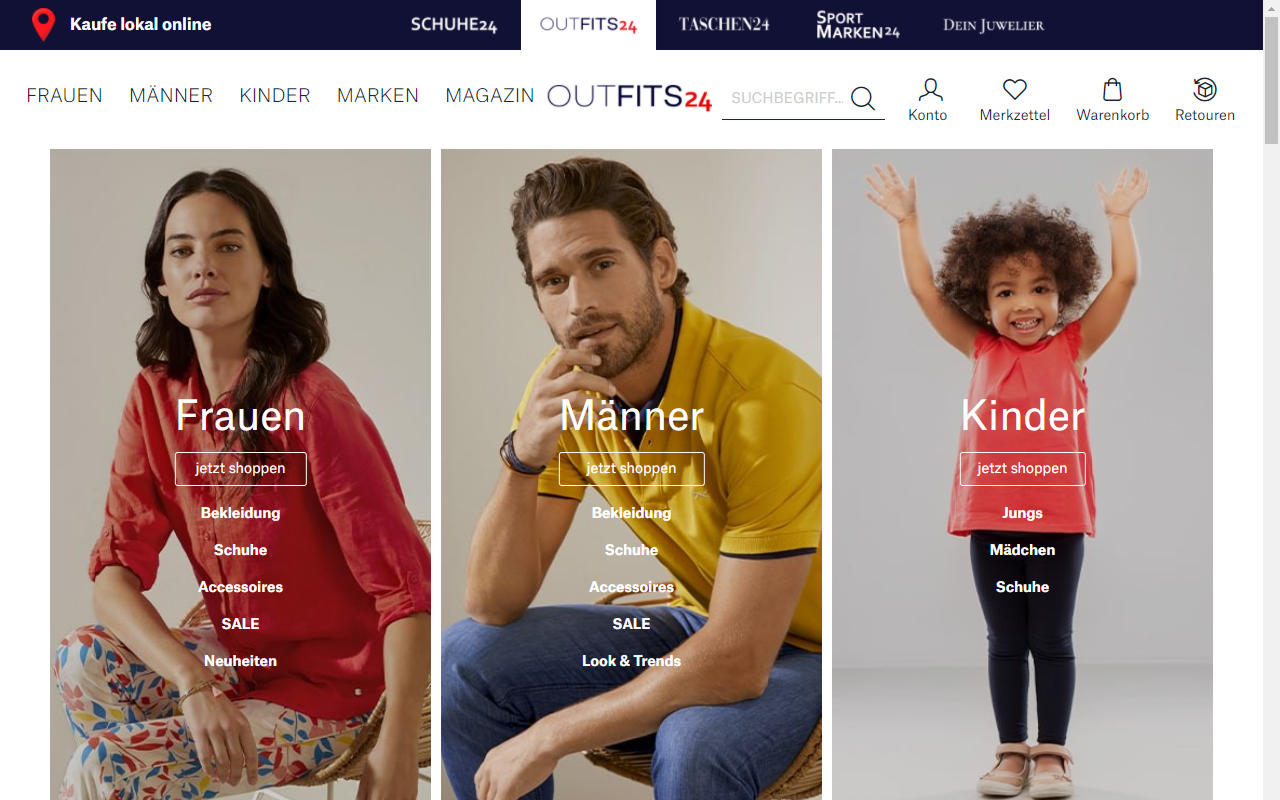

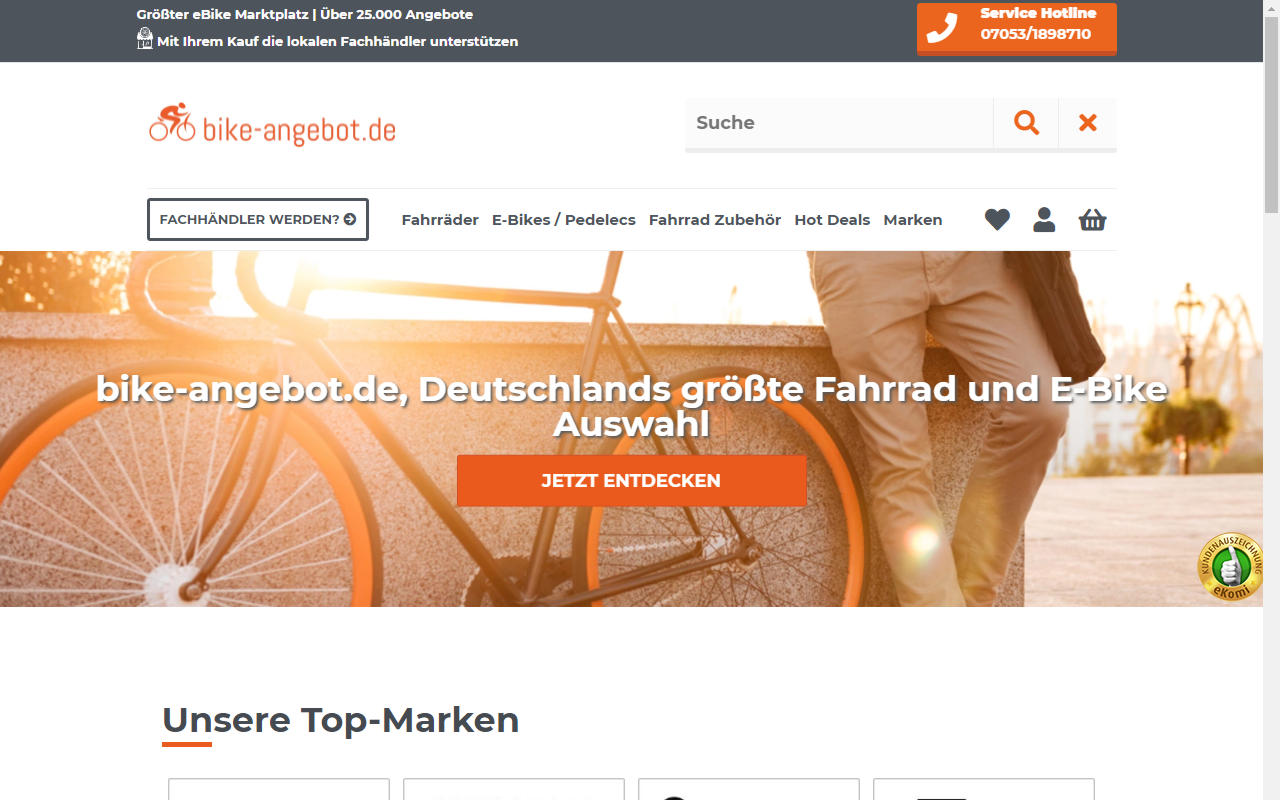

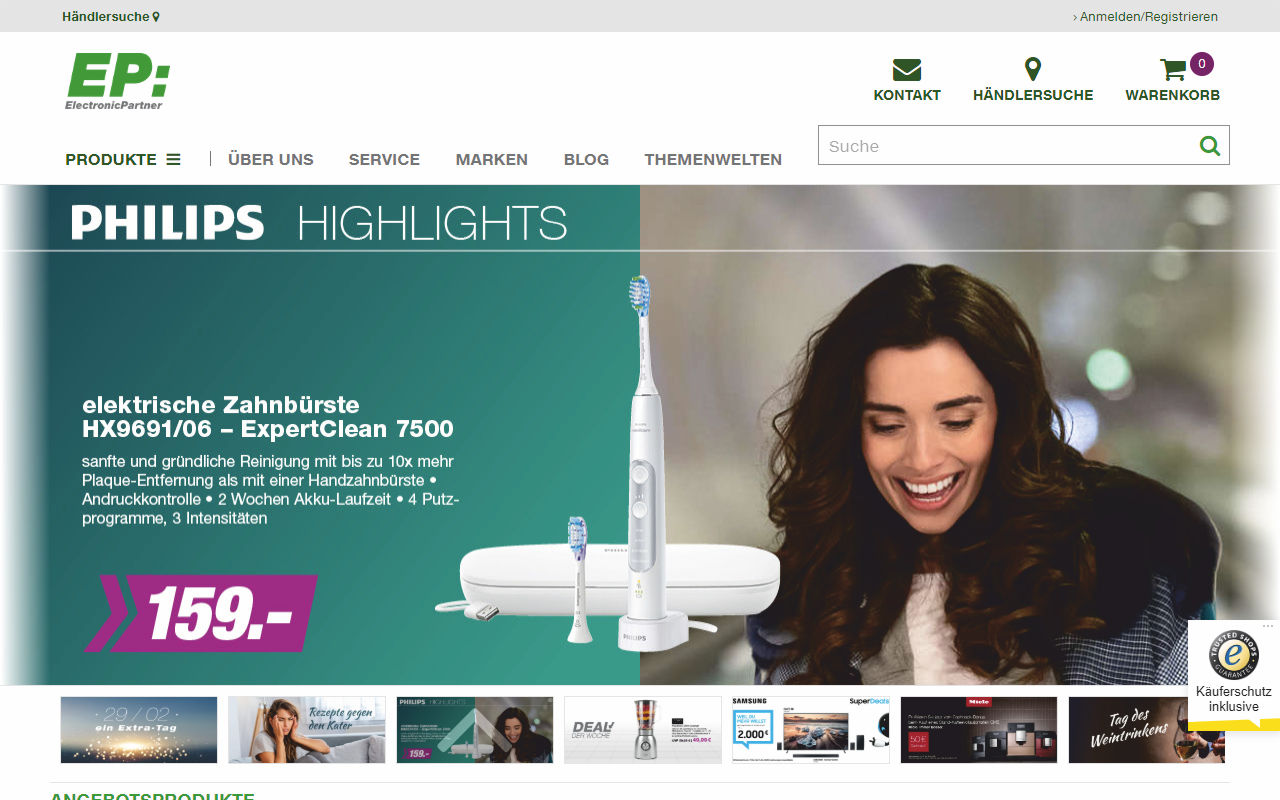

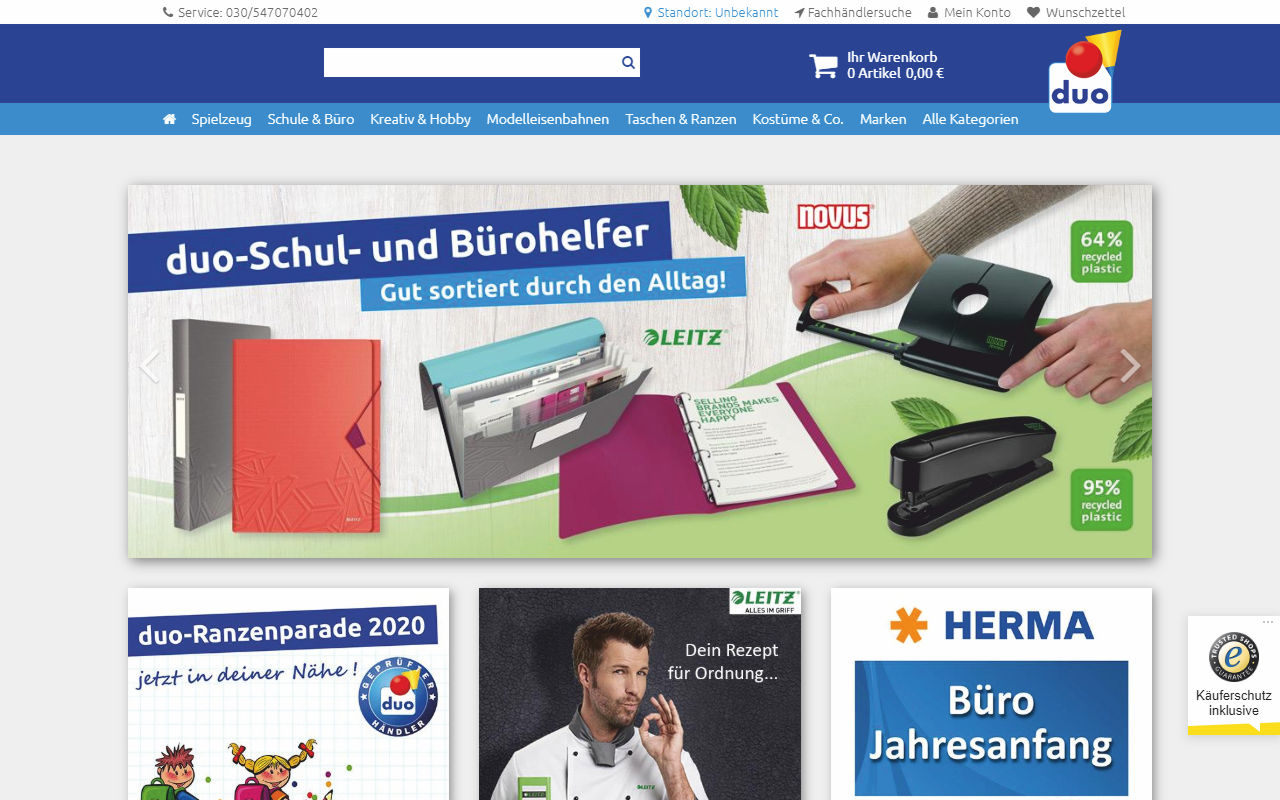

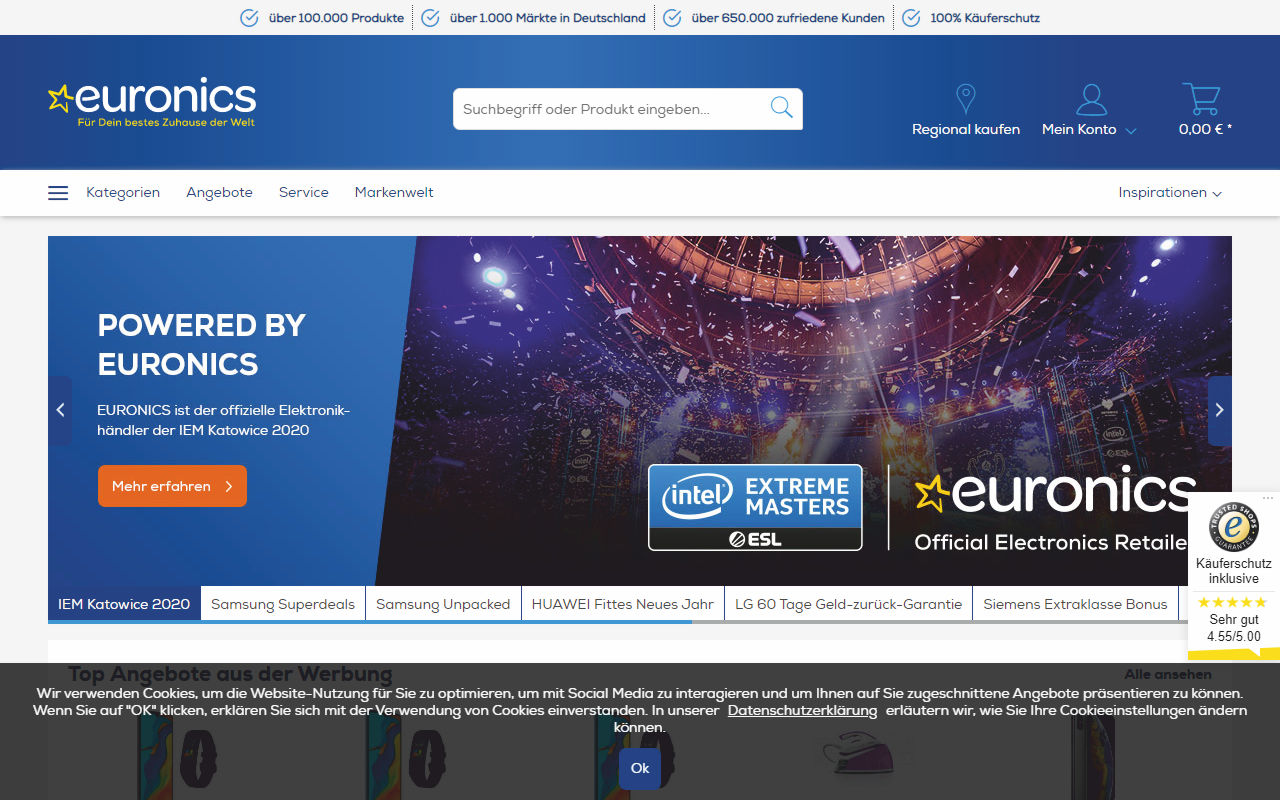

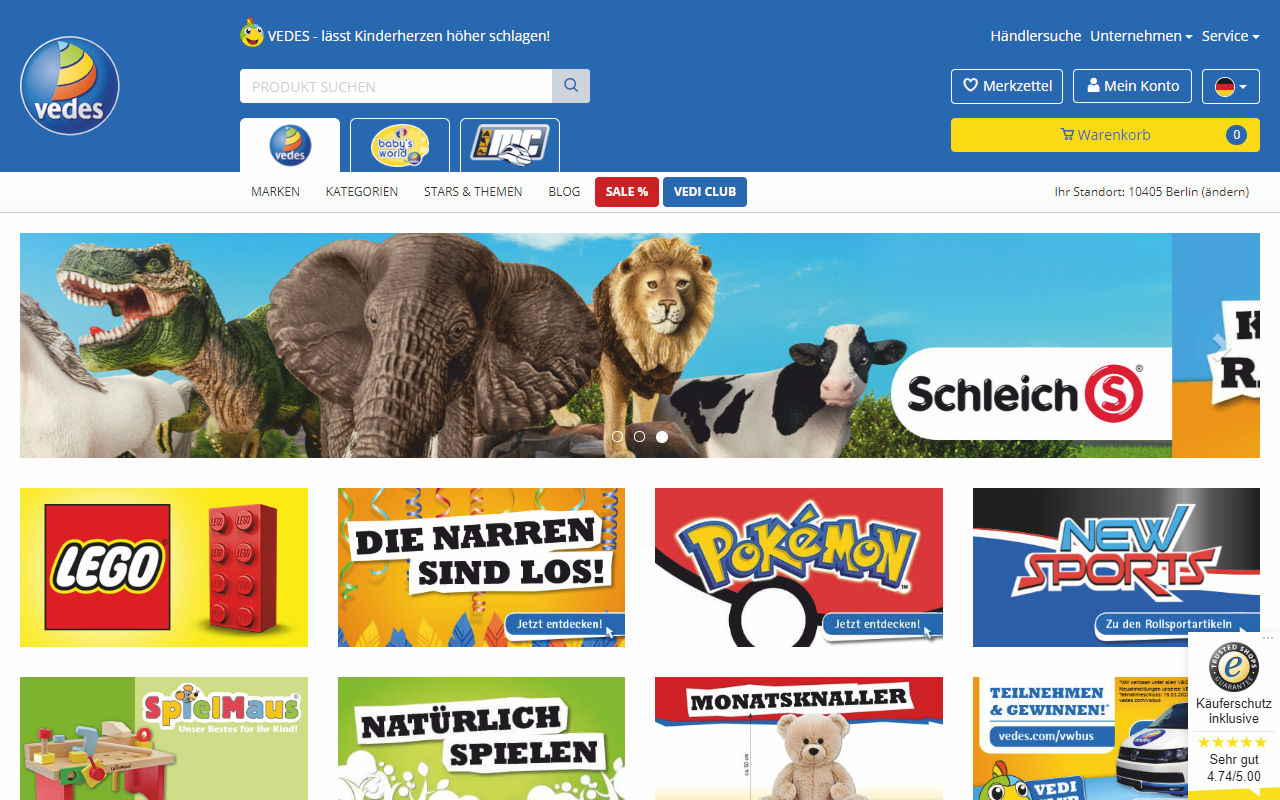

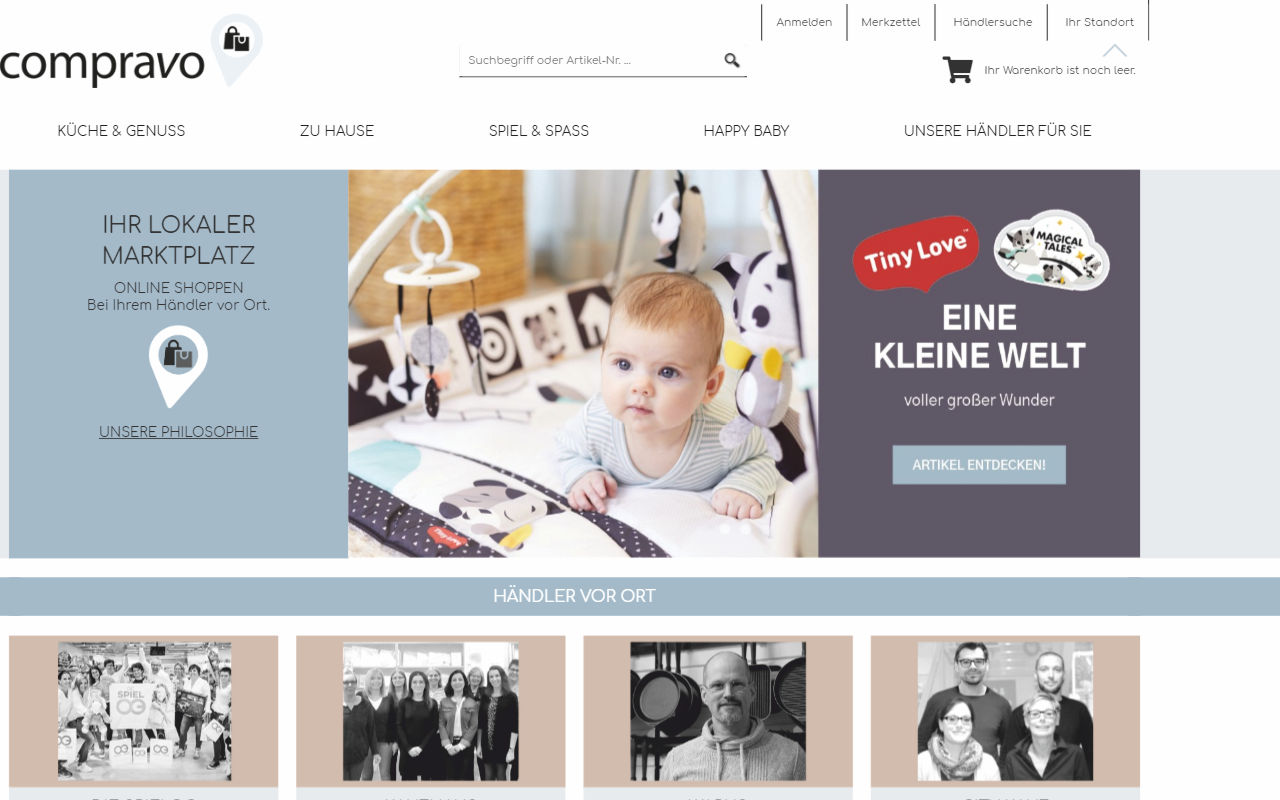

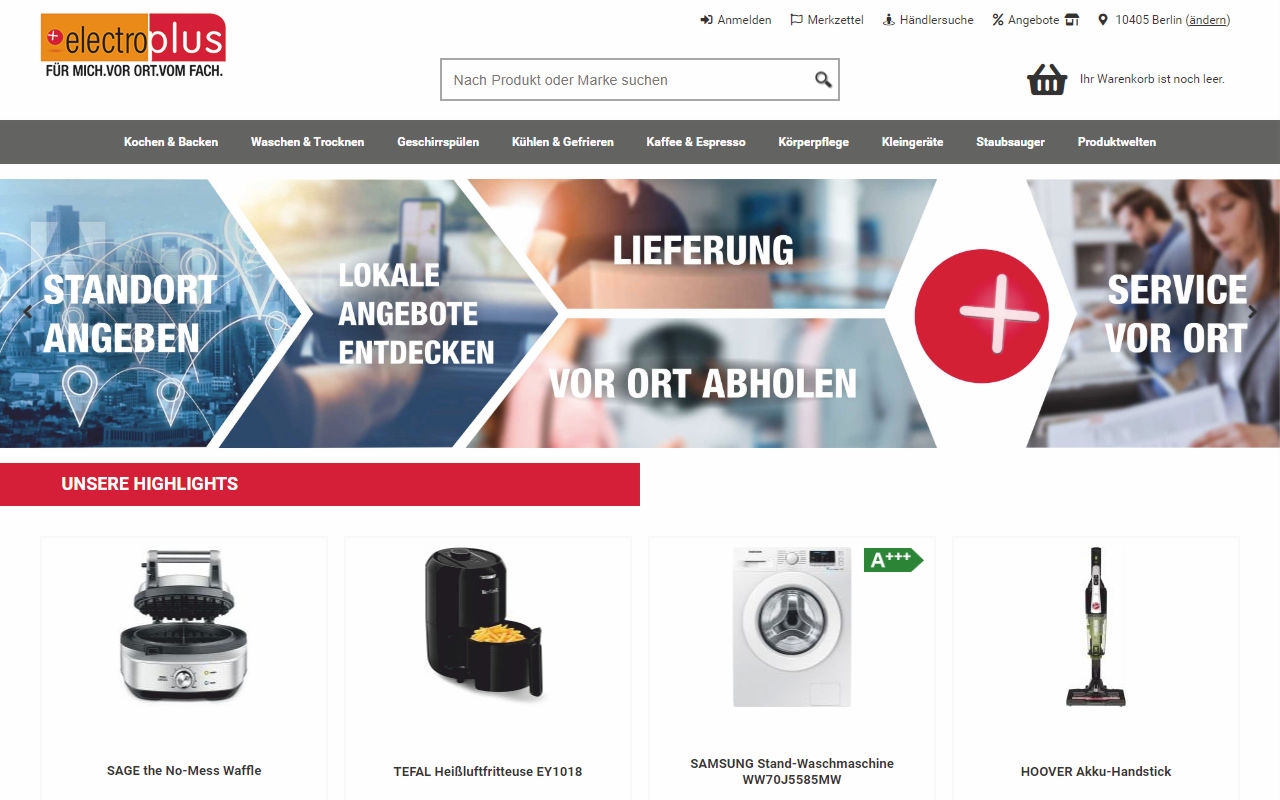

Examples of vertical online marketplaces (click to enlarge)

A detailed analysis of buying groups and their digitization concepts was already made by eStrategy Consulting in a separate study and is available here.

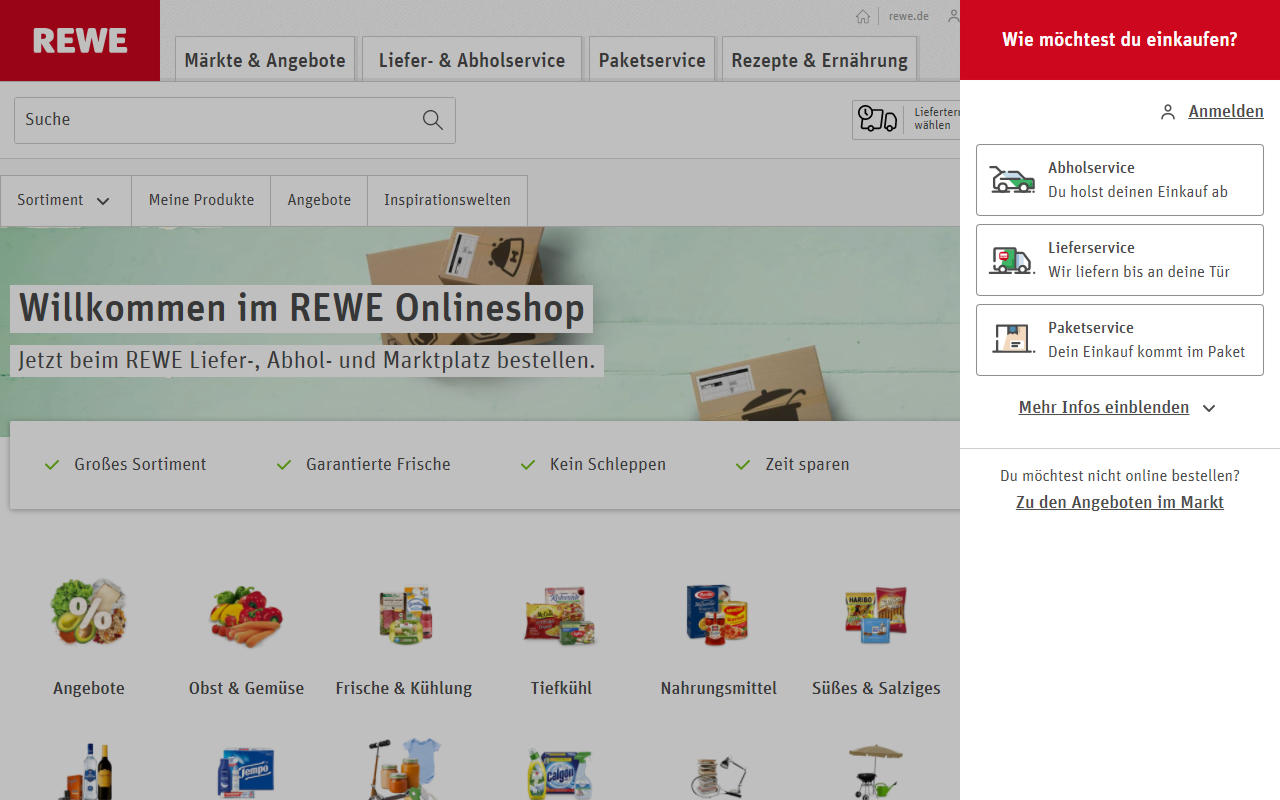

Approaches of established marketplaces and platforms

The last category in this study are approaches of established marketplaces and platforms. These also provide stationery retailers and stores numerous ways to achieve visibility. By joining, traders mainly gain wide reach and supraregional, Germany-wide, and even partly global demand. However, the marketplaces also cater to the local retail trade’s needs by offering pick-up of goods locally.

As part of the partial corona-related lockdown, many established platforms offered special conditions and relief for stationary trade, which eStrategy Consulting has already assembled here back in April.

Evaluation of established marketplaces and platforms

The established marketplaces and platforms offer stationary retailers various options for supporting local business. However, it can be said across the board that there is significantly greater potential for comparable effort. Even if not all platforms aim to combine local supply and local demand, what all the initiatives listed here have in common is that they at least aim to offer local retailers new opportunities and additional online demand. The big brands and retailers have long since embarked on this path, and small stationary retailers should not close their minds to these opportunities either.

Short profile & contact – eStrategy Consulting

eStrategy Consulting helps clients use digital innovation to further develop existing business models and develop new business opportunities. We support the retail industry in the further development of omnichannel and Connected Commerce. Manufacturers, classic big box retailers, the trade real estate industry, and digital marketplaces and platforms are among our customers.

eStrategy Consulting covers the entire life cycle of digital innovation. We support our clients from the initial idea analysis to the solution development to market introduction. As concept developers, we embed into teams and work as implementation managers. We count on a blend of methods from the world of digital business and traditional business consulting.